A Year in Review

Message from the CEO

Adam Auer President and CEO Cement Association of Canada

« No amount of sophistication is going to allay the fact that all your knowledge is about the past and all your decisions are about the future. » – Ian H. Wilson (former GE executive)

Dear Board members and colleagues:

2025 reminded us how difficult it is to lead with clarity in times of disruption. This was a year of unprecedented change, with economic, environmental, and political pressures pulling in unpredictable and often conflicting directions. This demanded of all of us a certain amount of agility, but most of all a tremendous amount of discipline to be responsive but calm, adaptable but focused, and above all, to “keep the most important things the most important things.”

I am very proud of how the CAC – and the industry more broadly – navigated these challenges, maintaining forward momentum even as the ground beneath us shifted.

When the 2025 election swung dramatically away from an almost certain conservative majority to a liberal minority under Prime Minister Carney, we leaned on our years of consistent, collaborative, and principled advocacy to strengthen our political positioning, elevate our influence, and advance priority files critical to member competitiveness and industry modernization.

When climate change softened as a policy priority for both federal and provincial governments, we did not abandon our commitments. Instead, we aligned our decarbonization ambitions within the emerging language of energy security, national sovereignty and economic competitiveness, positioning our industry as a modern driver of resilience, prosperity and clean growth.

When the economy continued to soften, the CAC didn’t just rationalise its budget, we invested in strengthening our foundations – better market intelligence, a modernised approach to codes and standards, and education, engagement and advocacy rooted in market fundamentals.

2025 tested us but also made clear that we have been successful in cultivating interest and awareness of our sector and the important role we play in society. From the strong response to our industry perception survey, to growing literacy about our sector among politicians and other stakeholders, to surpassing one million listeners on our Speaking Concretely podcast, there is an appetite among Canadians to learn about our industry and a huge opportunity to channel that interest toward our priorities.

The CAC has an exceptional team, distinguished not only for their competence but also for the genuine passion they have for the industry. We understand the importance of our sector and are driven to amplify its contributions to our economy and society. In 2025 our team became even stronger with the addition of three new staff members, including Blake Arsenault and Matt Dalkie on our Industrial Decarbonization team and Mick Prieur, who has assumed Tim Smith’s (now retired) technical responsibilities, while also expanding his role to include our codes and standards work and R&D initiatives. Blake, Matt and Mick are all extraordinary talents, and it is a tremendous point of pride that they have chosen to apply their skills with the CAC. I would be remiss not to once again thank Tim Smith for his immeasurable contribution to the industry over his 35-year career. I know we all wish him happiness, health and fulfillment in retirement.

Finally, through all of this, the CAC has been supported by an engaged and effective Board of Directors as well as strong communication and collaboration among our allied associations. I am deeply grateful for the trust placed in the CAC and for an ever-strengthening collaborative spirit across the industry.

2026 will no doubt test us further, and while the past does not always predict the future, it gives us every reason for confidence. Our disposition is one of confident ambition, determined to seize the crisis of opportunity to shape a stronger future for cement and concrete in Canada.

Adam Auer

President and CEO

Cement Association of Canada

Industrial Decarbonization and Sustainability

2025 was a year that challenged us to demonstrate how decarbonization is irrevocably linked to competitiveness and economic prosperity for our industry, and the country. With government funding priorities focused on addressing the most immediate issues at hand, namely trade relationships and managing tariffs, we focused our attention to where we could have the greatest impact. This included leveraging stable and predictable funding for the industry through changes to the federal Investment Tax Credits and being nimble in supporting members in different parts of the country where emerging challenges threatened competitiveness.

Policy Agenda: Leading with Competitiveness and Creating the Economic Conditions to Support Investment in Decarbonization

The Economics of Decarbonization: Attracting investment

With opportunities for public financing rapidly dwindling, the CAC shifted focus away from application-based funding programs, to create a stable, predictable financial support mechanism for projects through the federal Investment Tax Credits. As a direct result of the CAC’s lobbying efforts, the federal Clean Technology Investment Tax Credit was expanded to include a 30% tax credit for all capital equipment used in the generation of electricity and/or heat from waste-based biomass. This tax credit will support all qualifying alternative fuel projects in our industry. With increases in lower carbon fuels being a significant part of our Net Zero Action Plan, this tax credit will aid in attracting investment in cement plants and help meet the required emissions reductions. Once design details are published, CAC member companies could be eligible for capital tax credits in the millions of dollars. We look forward to working closely with members to maximize opportunities.

We also continue to support member companies individually when they seek access to government funding for projects. To further support our members in accessing government funding, we have developed a training program. The program focuses on how to locate and apply for funding with different levels of government to support the greatest chance at success to leverage public financing. We look forward to rolling out this program in 2026.

Procurement: Buy Canada

As the Canadian economy has entered a period of disruption and uncertainty in 2025, many sectors have been impacted, including the cement industry. The industry has been facing higher displacement due to growing volumes of imports following the adoption of the EU’s Carbon Border Adjustment Mechanism. As well, the threat of U.S. tariffs on Canadian goods and the upcoming renegotiation of the Canada—United States—Mexico Agreement has created additional uncertainty for Canadian cement manufacturing, as the United States is a critical export market for Canadian cement.

The CAC has been engaged at various levels and jurisdictions of government – including federal, provincial and municipal – to encourage the adoption of a Buy Canada policy for public procurement projects, to support continued demand for locally-manufactured cement.

In particular, the CAC has promoted the Treasury Board of Canada Secretariat (TBS) Standard on Embodied Carbon in Construction, which sets requirements to disclose and reduce the embodied carbon from concrete used on applicable projects. This Standard, put in place in 2022, creates requirements for public infrastructure projects to reduce the embodied carbon associated with the cement and concrete used. As a result, the Standard benefits domestically produced cement, which boasts significantly lower embodied carbon when compared to imported cement. If adopted more widely, the Standard would be highly effective for governments prioritizing domestic procurement while remaining adherent to international law and relevant trade agreements.

The CAC has engaged with the federal government, the Government of B.C., the Government of Ontario, and the Metro Vancouver Regional District with success across jurisdictions in adopting a domestic-first procurement policy:

- Federally, the government’s Build Canada Homes Investment Policy Framework released in November 2025 notes that the new agency will prioritize low-carbon building materials, and it specifically names low-carbon concrete.

- In Ontario, the government tabled the Buy Ontario Act in November 2025. If passed, the legislation would prioritize public procurement of Ontario goods, including cement and concrete. The CAC remains engaged with the Ontario government as they are currently working to develop the associated regulations.

- The Metro Vancouver Regional District has indicated that they are pursuing an approach similar to the TBS Standard for public infrastructure procurement.

Carbon Pricing: Preparing for the 2026 Review

Carbon pricing received a lot of attention in 2025, most notably with the election of a new federal government. The cancellation of the consumer carbon price meant that attention was directed towards the state and future of the industrial carbon price. The cement company CEOs shared their support for industrial pricing through an open letter to Prime Minister Carney, as discussions have begun behind the scenes on the review of industrial pricing systems across Canada. The CAC was clear that any weakening of the industrial price signal will dampen and even eliminate investment.

CAC joined a coalition of associations, companies, and environmental think-tanks to recommend that industrial pricing in Canada improve in 2026, through alignment of the provincial systems that allow for the transfer of compliance or performance credits across the country. At the same time, we advocated that Canada continues to recognize the cement industry as a high-risk emissions intensive, trade exposed industry, and therefore worthy of protection from unfair competition in the market from foreign actors.

British Columbia and Alberta both began reviews of their respective industrial pricing systems this year – with Alberta announcing substantial changes. Quebec is also planning some amendments to its cap-and-trade regulations. We will continue to advocate in 2026 for rational solutions for industrial pricing regimes, that spur investment in decarbonization while protecting the economic strength and competitiveness of the cement industry.

Carbon Accounting Taxonomy

We continued to progress in our efforts to build consistency and transparency in carbon accounting and environmental reporting. 2025 saw the design, consultation, and release of a new Product Category Rule (PCR) for cement – a significant advancement from previous versions. The cement PCR will enable proper reporting of decarbonization efforts across the industry as it has greater rigour in the use of data and the inclusion of carbon capture in the system boundary.

With the release of the new cement PCR, work began amongst CAC members to assess the opportunity for further alignment – beyond what is required by the PCR. By using the same data sets and assumptions across CAC member companies, we hope to be the first industry to create commercially comparable Environmental Product Declarations (EPDs), providing users with an accurate, evidence-based and informed choice for products. Leveraging the $360,000 we raised last year through partnership with the National Research Council, we hope to have a commercial-ready certification scheme by mid-2026.

We have also begun work on updating our cement industry average EPD. Completed last in 2023 and using 2020 data, we are updating to align with the new cement PCR, and to be on the same update schedule as the American Cement Association (ACA) and the Canadian Ready-Mix Concrete Association (CRMCA). To support this effort, the CAC is once again collaborating with the National Research Council.

Provincial-Level Actions: Ensuring Regional Alignment with our Competitiveness Agenda

Spotlight: British Columbia

CleanBC Review

The CAC was significantly engaged with the ongoing review of CleanBC, the Government of British Columbia’s plan to lower emissions by 40% by 2030. CleanBC offers a suite of programming, rebates, incentives and policies across various topics in support of their roadmap to 2030.

Through both in-person and written engagement, the CAC has emphasized that CleanBC’s policy and programming should be updated to focus on bolstering economic resiliency and safeguarding B.C.’s competitiveness. Specifically, the CAC has promoted the following:

- Review of the provincial Output Based Industrial Pricing System (OBPS) to update and correct the approach to alternative, waste-based fuels to ensure the integrity of the program and incentivize all low-carbon biogenic fuel sources;

- Implementing a procurement policy that emphasizes low-carbon building materials, namely the federal TBS Standard on Embodied Carbon in Construction; and

- Renewed funding and investment programs to ensure continued competitiveness and investment attraction for B.C.’s cement and concrete sector.

The results of the CleanBC Independent Review Panel, released in November 2025, noted the importance of continued manufacturing of cement in the province. As well, the Panel noted the importance of B.C.’s industries becoming “cleaner and more competitive”, including the importance of building on the strengths of the OBPS program.

Air Quality Regulations in Metro Vancouver

Over the summer of 2025, the Metro Vancouver Regional District (MVRD) put forth a series of amendments to their Air Quality Management Fees Regulation bylaw. This bylaw impacts both cement plants in the province, as both are located within the Metro Vancouver region.

Members and the CAC were deeply concerned with the proposed amendments, particularly as they related to permit fees. The proposed fee limit of $450,000 for new and revised permits would have levied unjustified and onerous costs to cement plants, with limited transparency and certainty, at a time where competitiveness and protection of regional manufacturing at B.C. is critical.

The CAC took decisive action with multiple actors: through engagement with officials at MVRD who drafted the proposed regulations, as well as with many officials and politicians in the provincial government and with MVRD Board Members who sit on applicable committees. Through these avenues, the CAC stressed member concerns and advocated for a lower fee limit for permits to be adopted.

Following months of engagement, the MVRD postponed the planned schedule to update their bylaws, originally planned for November 2025. In the most recent meeting with officials at the MVRD, the CAC has learned that the proposed bylaws will be amended to reflect a permit renewal fee limit of $125,000, significantly reduced from the original proposal of $450,000 – a savings to member companies of over $300,000 per facility. The CAC expects this new fee limit to be considered by the MVRD Board in early 2026 and will support the adoption of the lower fee limit.

Spotlight Ontario

Buy Ontario

Over 2025, the CAC has engaged significantly with many different ministries and departments within the Government of Ontario to encourage administrations to adopt a Buy Ontario policy for public procurement projects.

In November, following the CAC’s Ontario Lobby Day, the government tabled the Buy Ontario Act, which will prioritize public procurement of Ontario goods, including cement and concrete. The CAC remains engaged with the Ontario government as they are currently working to develop the associated regulations. In particular, the CAC will continue to promote the Treasury Board of Canada Secretariat (TBS) Standard on Embodied Carbon in Construction as an easy-to-implement policy for prioritizing domestic procurement while remaining adherent to international law and relevant trade agreements.

Geologic Carbon Storage Act

Ontario has been working to enable a carbon capture and storage (CCS) framework and associated regulations in the province through the proposed Geologic Carbon Storage Act. Consultations began in March 2022, and the CAC has participated in all relevant requests for submissions, including the most recent consultation in September 2025. The Bill received Royal Assent in December 2025.

Throughout the entirety of the consultation process, the CAC has emphasized the importance of a clear framework for CCS projects in Ontario, with certainty regarding the processes for permit issuance, transfer of liability, pore space rights, and land access.

We have also consistently noted the importance of:

- Establishing fair and open access as a key regulatory principle, as is the case in Alberta;

- Creating complementary economic incentives to spur CCS project development in Ontario, particularly for hard-to-abate sectors like cement with high upfront costs to implement CCS technologies; and

- Providing clarity on the transportation infrastructure needed to transport captured and compressed carbon, including pipelines, ships or road transport.

The CAC will continue to engage with members, other industrial stakeholders, and government on the implementation and development of the relevant regulations to ensure the government puts forward a successful framework for CCS investment in Ontario.

Research Agenda: Driving Competitiveness and Supporting the Economic Conditions for Investment in Decarbonization

This year, our research agenda was focused on building on the foundations of Concrete Zero, our net zero action plan, and framing decarbonization as part of our competitiveness agenda. We also utilized our research capacity to deliver briefing notes to government on actionable policy regarding tariff mitigation responses and federal transfer pricing models.

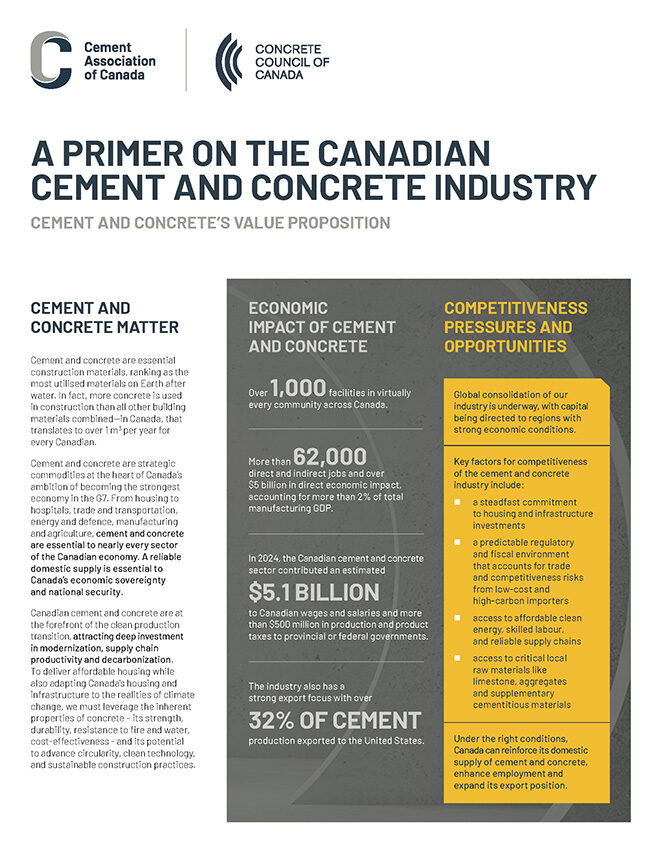

Notably, we updated our economic impact modelling, which now provides modern, realistic, and defensible data on the positive impacts the cement and concrete industry provide to Canada’s economy. This data was essential to supporting various lobbying efforts over 2025 and will continue to support our advocacy efforts going forward.

We also commissioned a study on near term guidance to enable mid-century net-zero while maintaining competitiveness. Focused on achieving net-zero cement in Canada, the study looked at what technologies make sense for the industry on a regional basis, understanding that each region of Canada has different challenges and opportunities for decarbonization. The study accounted for when different technologies would be both viable and economically competitive. This study will inform future efforts in the industry as we work towards achieving our action plan targets.

Finally, we released a study on the future trajectory of zero-emission heavy duty vehicles in the cement and concrete industry – with a focus on ready-mix and cement trucks. This study was funded in its entirety by the federal government and the Transition Accelerator, with the CAC providing the necessary background information on how the industry functions.

Construction

Innovation

Concrete Zero – Education

The CAC has worked to engage, educate, and support members and allies in understanding and advancing the broader strategic priority of net zero and its impact on business development and competitiveness.

- The CAC sponsored the Canadian Green Building Council (CAGBC)’s 2nd National Embodied Carbon Summit. Sixty participants from leading consultancies, academia, and government attended the summit to identify gaps, barriers, and potential solutions for developing a national approach. CAC secured four spots (CAC, CRMAC, 2 members) to represent the cement and concrete industry, where previously no one from our industry was present

- We continue to support our education mandate and to collaborate with allied associations such as the Canadian Concrete Masonry Producers Association (CCMPA), Concrete Ontario, and the Canadian Ready-mix Concrete Association (CRMCA) through the Concrete Council of Canada (CCC) to promote education on lower-carbon cement and concrete products.

- The CAC has continued to work with the CCMPA to develop and deliver half and full-day in-person carbon education sessions to more than 400 participants across multiple events hosted in Ontario, Alberta, and the Atlantic. In particular, the CAC developed and delivered an hour-long session that provides the context and details of the cement industry and the Net Zero action plan.

- The CAC secured $250,000 in funding from the National Research Council Canada (NRC) to create a ConcreteZero training curriculum. The platform targets specific audiences in the construction decision-making value chain, including cement and concrete industry professionals, specifiers and engineers, procurement officers, architects, green building professionals, and policymakers. This work is progressing as planned.

- The CAC sponsored and presented at Concrete Ontario’s Lower-Carbon Concrete Symposium. This event offered an opportunity for ready-mix producers, product manufacturers, and industry leaders to collaborate and showcase the latest innovative low-carbon concrete technologies and products. From owners to engineers, contractors, architects, and sustainability experts, multiple disciplines shared invaluable insights on how to incorporate sustainable concrete solutions into construction projects.

- The CAC has released the 5th Edition of the Concrete Design Handbook. This is the premier guide for concrete design in Canada, covering many aspects of the structural design of reinforced and prestressed concrete buildings. It provides a comprehensive analysis of reinforced and prestressed concrete structures for both buildings and other applications. Key features of the 5th Edition include:

- Code alignment: Reflects changes in the CSA A23.3-19 standard and is aligned with the 2020 National Building Code of Canada.

- Comprehensive coverage: Analyzes the structural design of reinforced and prestressed concrete buildings.

- Sustainability section: Features a new section dedicated to sustainability and the use of lower carbon concrete.

- Updated seismic design: Includes updated seismic design requirements and new site-specific hazard calculations.

- Detailed examples: Provides new, detailed design examples for multi-storey buildings in cities like Montreal and Vancouver.

- The CAC has released the French translation of its Design and Control of Concrete Mixtures (EB101) 9th Edition.

The CAC has actively collaborated with key influencers and decision-makers in the procurement, architect, consulting, and engineering (PACE) community. Our actions include our silver-level sponsorship of the Carbon Leadership Forum (CLF) Toronto 2025 Awards in November.

CAC team members have also been providing presentations on the cement and concrete industry Net Zero Action Plan to leading builders, developers, engineers, and architects. We presented at various events including Concrete Expo 2025, ACI 2025 in Toronto, Concrete Ontario AGM, CRH Sustainability Session, Centre for the Sustainable Built Environment, Korean Delegation, and the Ontario Architects Association.

Buy Clean

- Housing and Infrastructure Communities Canada (HICC – formerly Infrastructure Canada) is now applying lower-carbon concrete requirements to the following funding programs:

- Canada Housing Infrastructure Fund – CHIF aims to accelerate the construction and upgrading of housing-enabling drinking water, wastewater, stormwater, and solid waste infrastructure, directly supporting the creation of new homes and increasing densification. This investment is part of the Government of Canada’s commitment to address the impacts of the housing crisis on communities of all sizes across Canada.

- Canada Public Transit Fund (~$3B/year permanent funding) – The Canada Public Transit Fund is a historic investment that will support transit in communities of all sizes across Canada. Announced in 2024, the Fund will provide $3 billion per year for public transit and active transportation infrastructure, beginning in 2026-27. The Fund will provide stable and predictable funding to address long-term transit goals.

- Metro Vancouver is developing a corporate low-carbon procurement policy to reduce the carbon footprint of concrete used in its infrastructure projects. The new policy will guide Metro Vancouver’s procurement choices related to cement and concrete products.

- CAC has successfully worked with Canada Green Building Council (CAGBC) to adopt a carbon budgeting approach, similar to the TBS Standard, to be integrated into their Zero Carbon Design Standard.

NGO work

CAC supported Pembina and Introba to develop follow-up reports to their report entitled “The Opportunity to Lead on Clean Concrete Procurement and Performance-Based Specifications to Support the Clean Cement and Concrete Industry in British Columbia”, which was released in 2024. The new reports will focus on clean concrete in the Ontario and Alberta markets and are planned to be released by the end of 2025.

Codes Canada

The CAC responded to the Canadian Board for Harmonized Construction Codes’ (CBHCC) policy position paper on addressing embodied greenhouse gas (GHG) emissions for new houses and buildings in the National Model Codes. The purpose of the paper was to gather feedback on the development of technical provisions in the 2030 code cycle. This is one of the most significant potential impacts on the cement and concrete industry in years. CAC’s response is located here.

Research & Development

In 2025, the CAC restarted its Product Standards & Technology Committee after 4 years of inactivity.

We also released the results of our 3-year R&D project on increasing limestone in PLC (20–25%), which was conducted in collaboration with the University of Toronto and the University of Ottawa.

After the October Federal Lobby Days, the NRC approached the CAC to develop an industry consortium for its research and development strategy for cement and concrete. The CAC has provided to the NRC a draft consortium agreement, which was developed in collaboration with our concrete allies.

The CAC has continued collaborating with the NRC on developing an industry-focused research program aimed at creating a Low Carbon Concrete Toolkit. This toolkit has the potential to significantly boost the acceptance and use of lower-carbon cements, concrete products, and solutions. The NRC has verbally committed to providing $2 million for this research and is in the process of establishing an agreement with the CAC to carry it out.

The CAC supported the launch of the NRC’s Low Carbon Built Environment Challenge program call for proposals to support the development of low-carbon cement and concrete products used in buildings and other infrastructure. This program is making up to $2 million available with anticipated funding of a maximum of $500,000 per project in the form of non-repayable grants or contributions over 3 years. The CAC supported the selection of research topics and served on the evaluation committee.

We are also pursuing research and development avenues that were identified a few years ago through a series of seven workshops held jointly by the CAC and the NRC. The workshop sessions addressed technologies related to kiln combustion, clinker production, cement, concrete, and carbon sequestration in concrete. A total of 75 knowledge gaps were identified across the sessions, with 60 related to cement and concrete, and 15 to alternative fuels and cement manufacturing.

Legislative and Regulatory Affairs

National Pollutant Release Inventory (NPRI)

Cement manufacturing facilities continue to report their releases to the environment through the NPRI administered by Environment and Climate Change Canada (ECCC). A CAC representative sits on the NPRI Consultative Work Group, which provides advice to the federal government on the implementation of the NPRI program. In 2025, ECCC added reporting requirements for 163 per- and polyfluoroalkyl substances (PFAS) to the NPRI. A PFAS will be required to be reported by any facility that manufactures, processes, or otherwise uses 1 kilogram or more of that PFAS at a concentration of 0.1% by weight or more, starting with the 2025 reporting year. While the use of PFAS in cement plants may not be as widespread as in other types of industrial facilities, there are challenges related to the lack of information about PFAS in products and the limited availability of PFAS laboratory testing on many products.

Risk Management of per- and polyfluoroalkyl substances (PFAS)

A consultation document on Phase 1 of the Risk Management of PFAS was published on September 26, 2025, for a 60-day public comment period. Phase 1 focuses on the prohibition of the use of PFAS not currently regulated, and in firefighting foams, but it excludes fluoropolymers. While Phase 1 is not expected to have a significant impact on cement plants, the CAC continues to monitor the situation and will reach out to members as necessary.

Other Issues

We continued in 2025 to monitor other national and international policy and regulatory initiatives that could have an impact on cement manufacturing activities. This included the risk assessment and risk management activities of the federal government for specific substances under the Chemicals Management Plan (CMP), as well as air quality policy development and implementation.

Political Landscape & Government Relations

As the voice of the cement and concrete industry on Parliament Hill, the CAC follows the federal political trends and developments. 2025 marked a year of significant political transition and strategic recalibration for the cement and concrete industry. With the resignation of Prime Minister Trudeau in early 2025, the unexpected fall in popularity of the Poilievre Conservatives, and the emergence of the Carney-led Liberal government, our government relations approach pivoted rapidly from preparing for a likely Conservative federal victory to engaging with a renewed, but very different, minority Liberal government.

And while there remained a Liberal party in power, Mark Carney’s focus and approach differs significantly from his predecessor. With less focus on environmental initiatives, and a focus clearly on economic issues, our messaging also pivoted to those more in line with what we were already promoting with the Conservative party.

Across the country, our work this year focused on building and strengthening political relationships, elevating competitiveness concerns in light of tariff uncertainty and broader global economic volatility and advancing initiatives to strengthen the economic viability of our industry. Our efforts included targeted advocacy, coordination with cross-border partners, leadership on tariff issues, and the execution of a federal lobby day with the new Carney government early in their mandate.

The summer and fall were dedicated to re-orienting our strategy toward the Carney government’s priorities and policy direction. Key achievements included:

- Rapid introductory engagement with senior PMO officials, Ministers offices, and policy leads across the new Liberal government.

- Reframing our competitiveness narrative around new economic risks, including the threat of U.S. tariffs, economic sovereignty and national security, and cross-border economic uncertainty.

- Ensuring early visibility for the cement and concrete industry during a period when the new government was setting its strategic agenda.

These efforts ensured continuity for priority files already underway while protecting our positioning and relevance with a new set of politicians and Ministers.

In keep with these efforts, we delivered our first federal lobby day since 2023 in early October, re-establishing the presence of the cement and concrete industry on Parliament Hill. The day ensured strong cross-partisan engagement at a time of significant political transition. With close to 25 meetings over a day and a half, the event allowed us to:

- Reinforce the message of cement and concrete as strategic commodities and the need for a reliable domestic supply to ensure Canada’s economic sovereignty and national security; and

- Highlight the core and critical role cement and concrete play in the construction of major, national building infrastructure projects, a central component to Canada becoming the strongest economy in the G7.

Our key messages for the day included enhancing Canada’s competitiveness, Canadian jobs, and support global investment by:

- Strengthening the industrial carbon pricing system and implementing key programs, including adjustments to the existing Investment Tax Credit suite;

- Implementing a “Buy Canada” procurement policy that emphasizes clean growth criteria to leverage the advantage of domestically manufactured cement and concrete products; and

- Streamlining resilient infrastructure spending, particularly in energy, transportation, trade, defence and housing projects.

Cross-Border Alignment and Tariff Working Group

Recognizing the emerging risks linked to U.S. tariff policy and post-election economic uncertainty, we convened and led a new tariff-focused working group in partnership with the American Cement Association. The group included Canadian and U.S. colleagues across member companies, with objectives to monitor evolving U.S. trade actions and their implications for Canadian cement, develop aligned advocacy positions to safeguard competitiveness, and prepare coordinated responses should new tariff measures be introduced.

Cement was ultimately excluded in the spring and summer round of tariffs, but this initiative strengthened cross-border collaboration and provided important groundwork should it be needed in the upcoming Canada-U.S.-Mexico Agreement (CUSMA) negotiations.

Provincial landscape

On the provincial level, this past year saw an early election called by Premier Doug Ford in Ontario. The election outcomes did not significantly change the political landscape as his Progressive Conservative Party captured a third majority government and the NDP remained as official opposition.

Across Canada, provincial Premiers rallied behind Prime Minister Carney as a reaction to the U.S. tariffs and worked together to put in place measures such as the elimination of barriers to interprovincial trade, hoping to boost the Canadian economy.

As the political and economic landscape evolved, driven largely by developments south of the border, our messaging focus shifted across the provinces. While our core policy priorities remained unchanged, we increasingly framed net-zero through an economic lens rather than an environmental one, emphasizing competitiveness, investment, and economic security in our communications. Looking ahead, the CAC will continue to work with provincial governments across Canada in 2026, taking advantage of the expected focus of most provinces on economic development.

We will also prepare for a provincial election in Quebec in October 2026, where a change of government is expected after two mandates of François Legault’s Coalition Avenir Québec (CAQ) government.

Western Region Highlights

In 2025, the CAC continued to advance its mission across Western Canada by strengthening collaboration with industry partners, engaging with provincial governments, and promoting innovation, sustainability, and industry growth. Working closely with our Provincial Allies including Concrete BC, Concrete Alberta, Concrete Saskatchewan, and Concrete Manitoba, the CAC played a key role in advancing shared priorities focused on building resilient, low-carbon communities and supporting Canada’s broader infrastructure goals.

Across Western Canada, CAC’s partnerships with regional concrete associations remain critical to advancing shared objectives. Together, these collaborations are helping to shape a more sustainable, innovative, and resilient future for the cement and concrete industry, one that supports strong communities and industry competitiveness and drives progress toward Canada’s housing and infrastructure ambitions.

Government Relations

British Columbia

The CAC participated in a Lobby Day with Concrete BC in Victoria in May. We highlighted the essential role of cement and concrete in achieving housing, infrastructure, and climate objectives.

The Lobby Day offered a valuable opportunity to engage newly appointed Ministers and introduce them to our industry, as well as to reinforce our relationships with existing Ministers. Our discussions focused on strengthening industry competitiveness, including improvements to the current output-based pricing system (OBPS), advancing Buy B.C. public procurement practices, and advancing infrastructure procurement. We had the opportunity to meet members of both the government and the opposition to highlight and reinforce the strength of the industry.

This provided a strong base for follow-up meetings in the Fall with the Premier’s office, Minister of Jobs and Economic Growth Ravi Kahlon, Deputy Minister of Energy and Climate Change, and Minister of the Environment Tamara Davidson, as well as many Opposition members. In addition to reinforcing our messages around procurement and the OBPS, we advocated on behalf of our members with respect to transparency around proposed fee changes with Metro Vancouver.

The CAC made a submission to the 2026 pre-budget consultations with the following key recommendations:

- Grow and accelerate B.C.’s investment in infrastructure projects, particularly energy, transportation and trade, and housing.

- Implement a “Buy B.C.” procurement policy that emphasizes lower-carbon building materials to leverage the advantages of domestically manufactured products such as cement, steel, aluminum, and forestry.

- Through the OBPS annual program review, consider updates to alternative, waste-based fuels to ensure integrity of the program and incentivize the use of waste-based, low-carbon biogenic fuel sources.

- Implement programs through CleanBC to ensure continued competitiveness and investment attraction for B.C.’s cement and concrete sector.

We continue to look for ways to strengthen our relationship with the BC government and advocate on behalf of members in British Columbia, particularly around protecting and expanding the domestic supply and use of BC-manufactured cement and concrete.

Alberta

The CAC and Concrete Alberta continue working with the provincial government to promote low-carbon innovation and highlight the cement and concrete industry’s role in supporting Alberta’s economic growth and climate objectives. In 2026, the CAC will expand its advocacy efforts, with a deliberate focus on strengthening government relationships and showcasing the economic and environmental contributions of our members across the province.

Saskatchewan

With our concrete allies, we continued in 2025 to underscore the industry’s leadership in supporting provincial initiatives, infrastructure investments, low-carbon solutions, and climate objectives. The CAC and Concrete Sask worked together to ensure policymakers recognize the essential role of cement and concrete in building resilient communities.

Manitoba

Manitoba remains a stable political environment under the leadership of Premier Wab Kinew. The CAC and Concrete Manitoba continued to align on advocacy priorities around infrastructure investment, sustainable construction practices, and infrastructure resilience. The partnership focused on ensuring that the cement and concrete industry plays a leading role in supporting Manitoba’s long-term economic, infrastructure and environmental goals.

Market and Technical Affairs

The CAC remained active and committed to our allies across the region working collaboratively to share information with municipal and provincial agencies and other stakeholders with the goal of expanding Concrete Zero awareness. In 2025, we continued to strengthen our presence and leadership, working collaboratively with industry partners, government, and stakeholders to advance the sustainability, innovation, and competitiveness of the cement and concrete sector.

Strengthening Industry Collaboration in British Columbia

The CAC actively participated in key provincial initiatives to support the growth and sustainability of the industry. Highlights included:

- Participation in Concrete BC’s Strategic Planning Session, contributing insights on policy, innovation, and advocacy.

- Supporting BuildEx Vancouver, where CAC staff discussed cultivating collaboration in the built environment and building together with other industry partners.

- A cement plant tour led by Concrete BC’s Technical Committee with officials from the BC Ministry of Transportation and Infrastructure, providing officials with first-hand insight into cement manufacturing and sustainability advancements.

- Participation in Metro Vancouver’s Solid Waste and Recycling Advisory Committee, supporting circular economy initiatives.

- Continued engagement on Concrete BC’s Board of Directors, contributing to advocacy and technical priorities across the province.

Strengthening Industry Collaboration and Knowledge Sharing in Alberta

Key activities included:

- Supporting Concrete Alberta’s Concrete Level II course at Southern Alberta Institute of Technology (SAIT), enhancing technical training and workforce development.

- Presenting at the Canadian Concrete Masonry Producers Association (CCMPA) Carbon Conversation 101 in Edmonton, highlighting Concrete Zero and collaboration opportunities across the building materials sector.

- Participating in the Richardson Roundtable, engaging with leaders on Western Canadian trade diversification and competitiveness.

- Co-hosting a Calgary Stampede event with many provincial and municipal politicians to strengthen relationships and promote industry contributions to the built environment.

- Delivering a keynote at the WPC Energy Canada Ignite event, highlighting the correlation between energy and climate resilience in the cement sector.

- Participating in BuildEx Calgary, showcasing low-carbon and sustainable construction solutions emphasizing the cement sector’s leadership in decarbonization.

- Engaging in the Alberta Innovates Workshop on Carbon Utilization and Conversion, supporting carbon circularity initiatives.

- Maintaining a strong presence at Concrete Alberta’s Annual General Meeting (AGM) and other member events, reinforcing collaboration on advocacy and sustainability.

Strengthening Collaboration and Industry Engagement in Saskatchewan

The CAC continued its collaboration with Concrete Saskatchewan, advancing shared goals in advocacy, education, and industry engagement to support the province’s economic development.

CAC actively supported Concrete Saskatchewan’s programs and events, including:

- Engagement at the Concrete Sask Annual Golf Tournament, fostering valuable industry relationships.

- Participation in Lobby Days at the Saskatchewan Legislature in May, where CAC and Concrete Sask met with Members of the Legislative Assembly and government officials to highlight the industry’s contributions to sustainable growth and innovation.

- Participation in Concrete Saskatchewan’s AGM to discuss industry priorities and opportunities.

- Election onto Concrete Sask’s Board of Directors to further strengthen ties to the region.

The CAC will continue working closely with Concrete Sask to advance innovation, strengthen advocacy, and promote infrastructure development across the province.

Manitoba

The CAC continued its collaboration with Concrete Manitoba, focusing on advocacy, industry engagement, and sustainable growth. The CAC supported Concrete Manitoba’s events and initiatives, including:

- Participation in Concrete Manitoba’s AGM to discuss emerging trends and industry priorities.

- Attendance at the Concrete Manitoba Golf Tournament, providing opportunities to engage directly with members and stakeholders.

We are looking forward to deepening our partnership with Concrete Manitoba in 2026 through continued collaboration on education, advocacy, and technical leadership.

Ontario Region Highlights

The 2025 year started with an early election on February 27th. With an election call over a year sooner than required by legislation, and a short campaign period, the Conservatives caught their opposition off-guard resulting in the Doug Ford government capturing a third majority government (the first time a party has done so in Ontario since 1959) and the NDP remaining as official opposition. The only significant change after the election was the Ontario Liberals finally regaining official party status, giving them more profile in the legislature and committees, as well as additional access to funds for their activities.

Government Relations

In alignment with the Ontario government, our messaging and asks were focused on key provincial priorities including housing, infrastructure, jobs, investment in Ontario, and economic security.

We focused on several key priorities over the course of the year: carbon capture, utilization and storage (CCUS), procurement, and investment in modernization and competitiveness. These priorities were reinforced in our close to 50 engagements with elected officials and their staff over the course of the year, including at meetings, cement plant tours, the Ontario Lobby Day, and various conferences and lunches with government officials, both elected and non-elected.

We also highlighted throughout the year the industry’s contribution across the U.S. border. Notably, upwards of 40% of Ontario’s cement production is exported to the United States, fulfilling nearly a third of U.S. import requirements. It was important to highlight the industry’s significant role in maintaining cross-border economic stability and supply continuity.

The CAC actively participated in key provincial initiatives to support the growth and sustainability of the industry. Highlights included:

- Ontario Pre-budget consultations to highlight industry priorities to the Standing Committee on Finance and Economic Affairs and the Minister of Finance;

- Participation in consultations on carbon capture, utilization and storage led by the Minister of Natural Resources and his Parliamentary Assistant;

- Co-hosting a high-profile reception at the Association of Municipalities of Ontario conference with other industry associations to enhance industry visibility and deepen engagement with key municipal and provincial decision-makers;

- Participation in a roundtable with the Minister of Infrastructure to talk about infrastructure investment in the province and competitiveness concerns;

- Engagement, along with Concrete Ontario, with the Minister and Ministry of Transportation to talk about future competitiveness issues for transportation in the province; and

- Attendance at two provincial press announcements by Ministers, including funding for Skills Development Training for Concrete Ontario with the Premier and Minister of Labour, and the announcement of Buy Ontario with the Ministers of infrastructure and Public and Business Service Delivery and Procurement.

Carbon Capture, Utilization and Storage

The CAC participated in several roundtable consultations with the government as they worked to enable Carbon Capture & Storage (CCS) in the province through the proposed Geologic Carbon Storage Act. The Bill received Royal Assent in December 2025.

The CAC has been generally supportive of the government’s efforts to move forward on the CCS framework. Throughout the consultation process, we have emphasized the importance of a clear framework for CCS projects in Ontario, with certainty regarding the processes for permit issuance, transfer of liability, pore space rights, and land access. The CAC continues to stress the need for regulatory clarity and certainty for project proponents.

Procurement - Buy Ontario

We were encouraged to see progress on this important initiative. Over the past year we engaged with the Ontario provincial government several times on this issue and have asked the government to protect and support made-in-Ontario manufacturing of cement and concrete and adopt a Buy Ontario public procurement policy for cement and concrete products. Highlighting the growing economic uncertainty due to the threat of tariffs and other international policies including Europe’s Carbon Border Adjustment Mechanism policy (CBAM), the Canadian and Ontario economies are at serious risk of losing domestic market share of cement to foreign competitors.

The CAC recommended that Ontario adopt the Treasury Board of Canada Secretariat (TBS) Standard on Embodied Carbon in Construction, which sets requirements to disclose and reduce the embodied carbon from concrete used in applicable projects. This standard has been in effect since 2022 and applies to all Government of Canada federal government construction projects over $5 million across Canada.

The CAC was one of a select few stakeholders invited to this announcement with the Ministers in late November with the legislation introduced in the legislature later that day and receiving Royal Assent in December. The enabling legislation provides the framework for further consultation on the accompanying regulations, and the CAC will be actively providing input throughout that process.

Ontario Budget Submission

Similar to previous years, we participated in the Ontario pre-budget submission process with the following key asks:

- Enable Ontario-based cement and concretes businesses to remain competitive by creating an investment and regulatory environment that attracts capital to the province – this includes in new strategic opportunities like carbon capture, utilization and storage (CCUS) as well as enhancing circular economy opportunities such as the use of waste biomass as a fuel in cement kilns.

- Use Ontario’s spending power to support local businesses and jobs and grow our economy.

- Promote the use of recycled concrete aggregate in the province at the municipal, regional, and provincial levels.

Engagement with Allies

We continue to build and strengthen our relationships with our concrete allies. This year at the annual Association of Municipalities of Ontario conference we co-hosted an industry-wide reception along with the Ontario Stone, Sand and Gravel Association, Masonry Council of Ontario and the Ontario Road Builders Association. The reception provided an excellent networking opportunity for the CAC and members to meet with municipal and provincial politicians and leverage the collective strength of our industry.

CAC hosted a joint event with the Ontario Road Builders Association, the Masonry Council of Ontario and the Ontario Stone Sand and Gravel Association at the Association of Municipalities of Ontario Conference at the National Art Gallery in Ottawa.

Ontario Lobby Day

Our 2025 edition was one of our busiest lobby days to date. In partnership with Concrete Ontario, we had over 18 meetings throughout the day with Cabinet Ministers, Premier’s office staff, MPPs and senior Ministerial staff in Ministers’ offices. We were able to reinforce the importance of the industry to the province and the industry’s role in helping the province meet its ambitious infrastructure goals.

This year’s efforts included:

- A record number of meetings across all major ministries, the Premier’s Office, and targeted MPPs.

- A unified message focused on supporting and protecting domestic cement and concrete manufacturing:

- A Buy Ontario procurement policy for cement and concrete;

- Access to provincial funding programs for transformative modernization projects that improve productivity, protect jobs and draw global capital into Ontario; and

- Increasing the speed of housing and infrastructure through lower development charges, harmonization of specifications, and access to close to market aggregate.

- Our popular evening reception that drew strong attendance from Ministers, senior staff, and legislators from all political parties.

This event continues to materially strengthen our relationships at Queen’s Park and elevate the visibility of our policy priorities.

Concrete Ontario Advocacy

We continue to work on specific provincial advocacy issues on behalf of our partner, Concrete Ontario. This year we supported the development and submission of a successful Skills Development Fund application aimed at addressing one of the sector’s pressing labour issues, driver recruitment and retention. This ongoing partnership continues to demonstrate the strength and value of coordinated advocacy across our two associations.

Quebec Region Highlights

The Coalition Avenir Québec (CAQ) Government, led by Premier François Legault, continues to show signs of fatigue as it enters the last few months of its second mandate. Not only does the CAQ trails in the polls, far behind the Parti Québécois (PQ) and the Liberals, but it also saw the resignation of two Cabinet Ministers in the Fall, including Minister of Health Christian Dubé, who was one of the most influential Ministers in the Government.

According to recent polls, the PQ would form a majority government should an election be held now. The PQ won a by-election on August 11 in the Arthabaska riding. It was the third by-election won by the PQ since the last general election. Voter turnout reached 59.5%, nearly 20 percentage points higher than the average for by-elections in Quebec since 1998. The candidate of the governing CAQ ranked fourth with only 7.2% of the votes. The CAQ had won this riding in the fourth previous general elections.

The Quebec Liberal Party (PLQ) is also experiencing a major setback. After more than two years without a leader, the PLQ elected former long-term federal minister Pablo Rodriguez as their new leader on June 14, 2025. The honeymoon was short-lived, however, when a series of ethical issues arose in the Fall regarding his leadership campaign. Rodriguez stepped down from the party leadership in December, becoming the shortest-serving leader in the party’s history. The Liberals are once again without a party leader, less than a year before the 2026 general election.

Facing low approval ratings, the CAQ Government prorogued the National Assembly’s fall session, hoping to start fresh for the last year of its mandate. On September 30, Quebec Premier François Legault delivered a speech to inaugurate a new parliamentary session. He outlined his intention to implement specific measures to facilitate the acceleration of economic and energy projects and to optimize government operations, including the reduction in the time taken to issue permits and authorizations. In November, the Government Fall Economic Update was released. It focuses on managing slow growth while leveraging opportunities in defense, critical minerals, and clean technology. The government aims to simplify bureaucracy to fast-track projects, increase Hydro-Québec’s production, boost strategic sectors like aerospace and artificial intelligence, and position Quebec as North America’s hub for mineral processing and extraction.

Government Relations

The Quebec government initiated a consultation process to review its 2030 GHG emissions reduction target, which is set at 37.5% below 1990 levels, and its 2050 carbon neutrality target. The CAC prepared a written submission and appeared at a Parliamentary Commission on November 27. Our key message was to promote the status quo (i.e. no change to the existing targets) and we also emphasized the critical importance of measures to help large emitters achieve emissions reductions and measures to strengthen the economy and attract investments in the province. The video of the hearing can be seen here.

The Government remains supportive of our industry’s action plan towards net-zero concrete but is concerned about its implementation. Under pressure from the population on the climate file, the Legault government wants to see emission reductions in the short and longer term. To that end, we have helped CAC members understanding and accessing available funding programs and have also organized meetings between cement companies and senior bureaucrats as well as political staff. The CAC also initiated a discussion with senior bureaucrats regarding the streamlining of authorization processes for the use of low-carbon fuels in cement kilns.

Industry Affairs

Working with partners remained a priority for the CAC in 2025. As a Board member of CPEQ (Quebec Environment Business Council), and a proactive player in CPEQ Committees, we took advantage of numerous meetings and opportunities throughout the year to discuss government programs and policies with other industry sectors, identify common concerns and develop joint strategies when appropriate. The CAC also had the opportunity to discuss with Benoit Charette, then Minister of Environment and Climate Change, during a CPEQ luncheon event.

CAC and member companies also continued in 2025 to participate in the Joint Committee with the Ministry of Environment, Climate Change, Wildlife and Parks. This formal committee provides a unique opportunity for cement sector representatives to get updates on all files from the Ministry that are relevant to our sector, to ask questions about these files and to express concerns as needed.

In addition to our work on the Concrete Zero Action Plan, the CAC and members have had interactions with government officials on many issues, including the cap-and-trade program, the process surrounding environmental authorizations, and the use of Supplementary Cementitious Materials (SCMs).

Cap-and-Trade program

The Quebec government had published a notice in 2024 stating its intention to amend the Regulation respecting the cap-and-trade system for greenhouse gas emission allowances (RSPEDE). Given the economic uncertainty that affected the Quebec economy in 2025, the government decided to postpone the amendments which are now expected to be published in early 2026. Among the elements likely to be included in the amendments are a gradual reduction in the limit on the use of offset credits, the transformation of the offset credit component into a reduction purchase mechanism as of 2031, and the upward adjustment of reserve prices, which acts as a price cap mechanism. As the implications for cement plants could be significant, CAC officials will analyze the draft regulations as soon as they are published, and work with members to advance and protect the interests of our industry.

Environmental Authorizations

Considering the Government’s stated priority to accelerate the issuance of permits and authorizations, the CAC and members met with representatives from the Ministry of Environment and Climate Change (MELCCFP) in October to discuss authorization processes related to the use of low-carbon fuels and new supplementary cementitious materials (SCMs) in cement plants. We will continue these discussions in the coming months.

Supplementary Cementitious Materials (SCMs)

Representatives from the CAC and the three member companies operating in Quebec met with Ministry of Transportation (MTQ) officials on September 25 to discuss the protocol and testing requirements associated with the use of SCMs. As it relates to the use of new sources of SCMs, cement producers believe the Ministry’s testing requirements could be streamlined while ensuring the same level of transparency and technical suitability. A written proposal was prepared and presented to the Ministry.

Market and Technical Affairs

An important part of our activities aims at promoting the sustainability and durability of concrete infrastructure. This is done through education on our industry action plan towards a net zero concrete in 2050, as well as through communicating to government officials the importance of our sector to the economy and to the achievement of Quebec’s GHG reduction targets.

We sought to enhance our collaboration with our allies in 2025, making a deliberate effort to speak from a unified voice. We were pleased to be involved in many events throughout the year, including:

- Concrete Week.Association Béton Québec (ABQ), the Quebec concrete association, held its Concrete Week in Lévis in February. As part of this event, CAC staff René Drolet presented the industry’s action plan towards net-zero concrete and some of the emission reduction initiatives that are being pursued by the industry.

- American Concrete Institute (ACI). We were proud to be a Gold sponsor of the ACI Quebec & Eastern Ontario Gala of Excellence in concrete design and infrastructure held in Laval in March. The event was attended by a broad range of actors in the construction sector.

- Grand Forum – Conseil des Infrastructures. In November, the Conseil des Infrastructures hosted its 15th edition of the Grand Forum, a large annual event attracting over 250 attendees from all sub-sectors of the infrastructure ecosystem. The CAC moderated a panel on the circular economy in the cement and concrete industry and how it supports infrastructure projects.

- Association Béton Québec (ABQ) events. The CAC participated in ABQ’s annual general meeting (AGM), as well as in the activities surrounding the ABQ annual cyclo-golf. We also attended the “Journée de l’ABQ” in October.

Atlantic Region Highlights

The CAC continues to work with the Atlantic Concrete Association (ACA) and their members on regional needs and messaging required for governments, customers and stakeholders to advance the industry in Atlantic Canada. We were pleased to increase engagement with ACA in 2025. Early in the year we supported the ACA at their AGM that was held in conjunction with World of Concrete. The CAC presented an update on Concrete Zero and the fact sheets and infographics developed by the Concrete Council of Canada highlighting intersections, municipal streets, provincial highways and concrete paving.

In the fall we had the opportunity to participate in ACA annual golf tournament and share information on the CAC’s cement and concrete innovation program. This program is being developed to increase the acceptance and uptake on lower carbon cement and concrete that includes low-carbon procurement tools, case studies, and research and development.

We look forward to strengthening our relationship with ACA in 2026 and working with them collaboratively on shared objectives and initiatives.

Marketing and Communications

Branding

The CAC launched a new refreshed and modern branding this year. It includes a slightly revised main logo and a completely new primary and secondary colour palette. This new exciting branding will allow us to stand out more effectively and will allow more flexibility to produce communication and marketing materials. The new branding started rolling out in October and will continue to be deployed across all our materials.

Social Media

The CAC continued further experimentation and testing on social media, posting more interesting and fun content to entertain our industry focused audience and connect with the more general public. We garnered almost 200,000 impressions on LinkedIn, with over 11,000 clicks. Our content drove engagement, with a 141% increase in comments over 2024. We saw steady growth on Instagram and Facebook as well, with a 189% increase in post impressions and 60% increase in post engagements on Instagram, and a 54% increase in new followers on Facebook. We have also been slowly working to expand our presence on YouTube, getting over 7,000 views in 2025, a sixfold increase over the previous year.

Emails

The CAC Monthly had an email open rate of 55%, a 21% increase from 2024 and well above the manufacturing industry average of 32%. We are exploring ways to further increase our reach over email, including more emails to the general public and non-members of the CAC.

Website

The CAC’s website surpassed over 200,000 pageviews in the past year, with over 100,000 unique visitors. Alongside our homepage, top pages included the Speaking Concretely Podcast, the Concrete Design Handbook, and our Concrete Zero Action Plan.

In addition to great performance, our website was completely re-designed and launched in December to reflect our new modern branding. The new website will allow more flexibility for further enhancements on content and will improve searchability for our audience.

Podcast

CAC continued publishing Monthly episodes of our popular podcast, Speaking Concretely. The medium has proven an effective way to grow our audience, give an extra voice to our members and to further advocate for the industry. Notable guests this year included: the Global Cement and Concrete Association, the Canadian Construction Association, Carbon Upcycling, and more.

Perception Survey

The CAC conducted a robust and important industry perception survey. This survey, which was answered by over 3000 people in the general public and nearly 200 industry professionals, provided incredibly vital information on how our industry is perceived and how our messaging is received. We will be using the results of this survey to shape our communication efforts and increase our visibility.

Video Series

One of the key marketing pieces for our team this year has been the launch of our member-focused video series. The first video of this series was launched at the end of November featuring our member Votorantim Cimentos. These videos shine a light on our people and our essential nature to Canada’s economy.

Market and Technical Affairs

Market Intelligence Program

The Market Intelligence program continues to mature and expand its capabilities. This year, the Spring Forecast was developed collaboratively with members’ market intelligence teams, strengthening alignment and shared insights across the industry. Later in the year, a Fall Forecast was commissioned from Oxford Economics to provide independent external validation of the Spring results. The Fall Forecast delivered a comprehensive analysis of the construction industry by sector and region, offering members a deeper and more robust outlook.

Transportation and Public Works

Education and Training

Part of the CAC role is to help educate public / private owners, engineering / architect consultants, and contractors of the many benefits of cement and concrete products used in infrastructure applications and about the Concrete Zero Action Plan. To assist in this process, we updated our PLC technical summary document and organized / participated in several webinars and seminars. The following is a highlight of some of the education and training activities:

- Concrete Manitoba January Pavement Seminar: CAC’s Tim Smith presented at Concrete Manitoba’s Concrete Pavement Mastery Seminar in Winnipeg. Tim’s presentation covered concrete pavement defects, maintenance, and repair.

- Scott McKay Concrete Technology Course Presentations: CAC staff gave two presentations at the weeklong training session – one on Concrete Pavement 101 and the other on Concrete Innovations. The course was attended by 26 students, and the presentations got a lot of discussions going on our industry’s Concrete Zero Action Plan.

ORBA Annual Conference: Tim Smith participated in the Ontario Road Builders Association (ORBA) conference for networking opportunities with the road building industry and to discuss the Concrete Zero Action Plan.

Engineered Soils Lunch & Learn Presentation for Muskoka Area Engineering and Roads Maintenance Staff: Tim Smith gave a Lunch and Learn presentation on Engineered Soils (cement-modified soil, cement-stabilized subgrade, cement-treated base and FDR with cement) to the Muskoka Area engineering and road maintenance staff. The presentation reviewed the four types of engineered soils applications and the construction processes for potential usage in the Muskoka area. The Muskoka Area engineering and roadway maintenance group tendered a road base stabilization test section as a direct result of the presentation.

- Third Annual Concrete Ontario / Cement Association of Canada Concrete Pavement Seminar: Concrete Ontario and CAC co-sponsored the Third Annual Concrete Pavement Seminar held in Oakville. The event was attended by over 55 people including consultants, municipal engineers, contractors, concrete admixture suppliers and university students. Topics included MTO update, City of Mississauga municipal concrete pavement, concrete roundabouts in the County of Essex, concrete pavement sustainability, non-destructive testing techniques, impact of electric vehicles on roadway design, next generation concrete grinding, and CPTech Center research and innovation update.

- Presentation at Concrete Ontario’s Fundamentals of Sustainable Concrete: Tim Smith gave a presentation on Road Map to Net Zero by 2050 at Concrete Ontario’s Fundamentals of Sustainable Concrete workshop.

- Good Roads Conference Presentation on Concrete Roundabouts:Tim Smith gave a presentation on Concrete Roundabout pavement thickness design, jointing and specifications at the Good Roads Roundabouts Session. Daniel Baggio from the County of Essex also gave a presentation on a concrete roundabout constructed in his County in 2024 and noted the reasons why concrete was chosen over asphalt.

- ACI Conference Presentation on Blended Cement Usage in Canada: CAC staff gave a presentation on Blended Cement Usage in Canada at the ACI Conference in Toronto which was attended by over 60 people. The presentation included a brief review of the Cement and Concrete Industry in Canada and the Concrete Zero Action Plan, a review of cement types in Canada, a review of the PLC Technical summary document, a table on blended cement availability across Canada and identification of where it is currently being used.

- Paper on Concrete Roundabouts Prepared for Presentation at TAC Fall Conference:CAC’s Tim Smith and Concrete Ontario staff co-authored a paper with the County of Essex on concrete roundabouts constructed in their area for presentation at the Transportation Association of Canada Fall Conference. The paper provided a review of the fundamentals on concrete roundabout design and construction, reviewed the construction of a concrete roundabout on County Roads 42 and 43, and highlighted the sustainable benefits of concrete roundabouts. The paper also looks at the CO2 footprint of the concrete roundabout constructed in 2014 compared to one constructed in 2024.

- TAC Spring Committee Meetings Presentation:CAC staff participated in the following TAC Spring Committee meetings to represent the Cement and Concrete industry: Maintenance & Operations, Soils & Materials, Pavements, and Pavement ME Design Subcommittee. In particular, the CAC gave a presentation update to the Soils & Materials Committee on the Concrete Council of Canada, Concrete Zero certification, Lower Carbon Concrete Symposium, and educational documents on PLC and lower carbon concrete.

- CAPTG / SWIFT Conference Concrete Related Presentations: Tim Smith and Mick Prieur participated in the CAPTG Workshop and SWIFT Conference Technical Sessions in September. Several concrete-related presentations were made at the two events.

- Presentation at TAC Pavement ME Design Subcommittee: Tim Smith gave a presentation on AASHTOWare Pavement ME Design – Opportunities and Challenges to the TAC Pavement ME Subcommittee. The presentation looked at the changes made over time to the concrete pavement portion of the software. It also identified the importance to use the software for optimizing the concrete pavement structure to reduce the carbon footprint while meeting all the performance requirements.

- TAC Conference Presentation on Concrete Roundabouts Paper: Tim Smith of CAC and Daniel Baggio of the County of Essex co-presented on a Case Study on the Use and Performance of Concrete Roundabouts in the County of Essex. The presentation, which was attended by over 50 people, looked at the construction and performance of the County’s concrete roundabouts as well as the benefits of concrete roundabouts and etched pavement markings.

- TAC Pavements Committee Presentation on Dowel Bars: Tim Smith gave a presentation on Dowel Bar Best Practices explaining the need for dowels, identifying current typical dowel load transfer systems and reviewed concepts for better load transfer systems looking at durability and sustainability. The presentation was attended by over 45 people.

- TAC Fall Conference and Technical Committee Meetings in Quebec City: CAC staff attended the Fall TAC Committee meetings and Conference sessions networking with the many government agencies and consulting personnel present. Four cement and concrete related presentations were given at the conference including presentations by CAC staff, Manitoba Transportation and Infrastructure, allied industry personnel, and University of Waterloo. CAC staff also took part on the panel discussion on Innovations in Materials and Construction Methods for Sustainable Pavements.

- MIT SCHub Advisory Committee: Tim Smith and Mick Prieur represented the Canadian Cement and Concrete Industry on the MIT SCHub Advisory committee to provide input on the MIT CSHub research work.

- Sponsorship of TAC Foundation AASHTO STEM Outreach Solutions Program: The CAC sponsored the November 6th TAC Foundation AASHTO STEM Outreach Solutions (SOS) program held in Ottawa. A total of 25 students from Grade 9 and 10 and five teachers from Lisgar Collegiate High School attended the session. This event was a hands-on educational program, developed by the American Association of State Highway and Transportation Officials, introducing students to transportation engineering through engaging Science, Technology, Engineering and Math (STEM) activities.

- McMaster University Graduate Student Presentations and tour of Canadian Centre for Electron Microscopy (CCEM): Mick Prieur attended the graduate student poster session to learn about the research projects currently in progress at McMaster. Topics were primarily around ground glass SCMs, UHPC and testing of containment structures for Ontario Power Generation.

- McMaster University CIVENG 3P04 Lecture:Mick Prieur presented to approximately 110 civil engineering students and graduate students on the cement and concrete industry path to net zero. Discussions included cement production, concrete mix design optimization, concrete element optimization, CCUS and how engineers can contribute to Net Zero in their future works.

- Good Roads Association – TM35 Scott McKay Concrete School: Mick Prieur is a Co-Chair for this week-long training session which educates 35-40 municipal inspectors, contract administrators, engineers and consultants. The training consists of topics from basics of cement, concrete, aggregates and admixtures to concrete testing, inspection, best practices, troubleshooting and sustainability.

- CPCI Conference: Mick Prieur attended the CPCI conference in Montreal in 2025 and sat in on their Technical committee and their Sustainability committee.

Technical Committee Involvement

The CAC assumes the secretariat function for the CAC Ontario Technical Committee which held four meetings in 2025. The key function of this group is to discuss Ontario’s Cement and Concrete Industries technical issues and liaison with MTO and Ontario municipalities on specification, certification, and testing issues. Other areas of discussion are marketing and promotional topics, liaison with OGRA Concrete Liaison Committee, liaison with Concrete Ontario and the research needs for the industry. Key accomplishments of the Committee in 2025 were as follows:

- Review of MTO’s New OPSS.PROV 1355 Precast Concrete Specification: CAC staff reviewed and provided comments to CPCI on the newly proposed MTO OPSS.PROV 1355 Precast Concrete specification. CCPPA and CPCI incorporated the comments into a cement and concrete industry response to the proposed MTO specification.

- PLC Primer: The CAC released a PLC Primer, which summarizes the CAC PLC technical summary document and FHWA PLC summary document, for use by cement and allied industry members. The document is intended to support the transition from GU to GUL- based concrete and to help address any challenges that may arise. The document can be found at the following link.

- Update PLC Technical Summary Document: CAC released an update to the Technical Introduction of Portland-limestone Cement for Municipal and Provincial Construction Specifications. The document now includes the updated information from Doug Hooton’s 2025 report on the 2022 visual ratings of outdoor exposure of concrete test sections for up to 140 months exposure in sulphate solutions. The document can be downloaded here.

- Concrete Care – Residential Flatwork Guide: CAC Ontario Technical Committee assisted in the development of Concrete Ontario’s Concrete Care – Residential Flatwork Guide. The document covers the performance requirements for exterior flatwork, identifies several points for quality construction, and identifies the importance of maintaining residential concrete including curing of the concrete, sealing the concrete and salt use. The document was released in July and can be found here.

Acting as representative for the cement and concrete industry, CAC staff promote the many benefits of concrete pavements, cement-based roadway solutions and use of PLC to a number of organizations and technical committees including the Transportation Association of Canada (TAC) committees, Ontario Road Builders Association (ORBA)/MTO Structures Technical Subcommittee, Concrete Ontario / MTO Liaison Committee, Good Roads Municipal Concrete Liaison Committee, Concrete Ontario Technical Committee, Concrete Ontario Sustainability Committee, Canadian Airfield Pavement Technical Group (CAPTG), American Concrete Institute (ACI) committees, and NRC’s Technical Committee for Infrastructure LCA Guidelines – Roadways, Bridges and Transit.

Some of the key outcomes from our involvement with these committees are listed below: