A YEAR IN REVIEW

Message from the CEO

Adam Auer President and CEO Cement Association of Canada

Dear Board Members and Colleagues,

Welcome to our modernized Year in Review! We’ve transitioned to a fully web-based platform to showcase our accomplishments more effectively. This format offers greater flexibility, eliminating limits on text, images, and layout. We can now include dynamic infographics and videos and enhance accessibility for a better user experience. A downloadable text-only version is also available for your convenience.

This change is just one example of how the CAC is modernizing its communication tools (read more below). It also reflects a broader modernisation of our approach to working with government, allies and other stakeholders to support our industry, particularly our transition to net-zero. The context in which we operate is changing, and we must constantly assess and adapt to new realities to remain effective.

2023 was a significant milestone for our industry with the release of our Concrete Zero Action Plan, which remains one of the most robust, transparent and collaborative roadmaps across sectors. In contrast, 2024 was the year the hard(er) work of implementation began, translating the opportunities and commitments laid out in our Action Plan into tangible investments and results.

We’re off to a tremendous start. In 2024, the CAC reoriented its engagements with elected officials, civil servants, internal and external stakeholders. We adopted a more disciplined focus on measurable progress against our Strategic Plan and Concrete Zero Action Plan, and I am incredibly proud of our accomplishments.

We played a crucial role in helping members and allies attract funding for well over $2 Billion in decarbonization projects across a spectrum of technology strategies, from carbon capture to low-carbon fuels to blended cements. These projects lay the foundation for achieving our 2030 target of reducing our emissions by 40% compared to a 2020 baseline.

We made substantial progress in developing and implementing our Carbon Accounting Taxonomy, a focused effort to improve transparency in carbon accounting to support the creation of more “commercial ready” decision-making tools. A robust carbon accounting framework is a pre-requisite for shaping markets that will enable cement and concrete producers to align decarbonization with competitiveness and profitability.

On the backbone of industry-first regionally specific Environmental Product Declarations (EPDs) published by Canadian cement and concrete producers last year, low-carbon procurement initiatives also made significant strides this year with the coming into force of the Treasury Board of Canada Standard on Embodied Carbon in Construction (which currently only applies to concrete products). We now have the components of a functioning demand-side policy that will in 2025 become the basis for substantial amplification of our engagement with policy makers and market actors to understand, standardize and scale demand for low-carbon concrete innovations. Stay tuned for exciting announcements in this space early 2025!

“We played a crucial role in helping members and allies attract funding for well over $2 Billion in decarbonization projects across a spectrum of technology strategies, including carbon capture to low-carbon fuels and blended cements.”

Of course, we continued to invest in meaningful relationships with all levels of government, our allies, construction sector leaders, environmental organizations, among others. I am particularly grateful for the support of our Allies, both bilaterally and through our collective efforts under the banner of the Concrete Council of Canada. Notable achievements include the release of the Net-Zero Primer and Cement and Concrete Policy Statement, the development of early elements of a Concrete Zero certification program, including shared training resources, and laying the groundwork for an industry-wide regionalised market perception survey in 2025. I was also delighted that our own Glen Furtado was elected to sit on several Ally boards and committees, deepening our capacity for alignment and collaboration. I am committed to this positive trend to maximize our combined capabilities and deliver greater value to our collective membership. Equally important, we continued to work closely with our colleagues at the Global Cement and Concrete Association (GCCA) as well as our American counterpart, the Portland Cement Association (PCA). Canada’s progress is proving valuable in the global context, even as we continue to learn and benefit from the efforts of our international peers.

Continue the CEO message here

Underpinning our progress in 2024 were significant changes to the organizational structure of the CAC. These changes were made to better align our team to our Strategic Plan in a highly dynamic political, economic and policy environment. The new structure comprises three branches, each headed by a Vice President: Industrial Decarbonization and Sustainability, led by Sarah Petrevan; Construction Innovation, led by Rob Cooney, whom we recruited from the National Research Council in June; and Public Affairs and Advocacy, led by Martha Murray. Deya Moran, who has consistently demonstrated exceptional performance overseeing CAC’s finances and administration, has been promoted to CAC’s Vice President of Operations.

I am grateful for the Board’s unwavering support and confidence through this transition, including for their approval of three new positions to enhance our capacity. In particular, I want to express my deepest gratitude to my Chair, David Redfern, whose guidance and mentorship have been instrumental in our success.

We also saw changes to the composition of our Board with the retirement of Filiberto Ruiz (St. Marys) and Alex Carr (Heidelberg East). We extend our heartfelt gratitude to both for their longstanding and important contributions to the industry. In their stead, we welcome Jorge Wagner (St. Marys) and Matteo Rozzanigo (Heidelberg East) who in 2024 have already infused our collective agenda with fresh energy and dynamism. I am equally thrilled to welcome a new member to our Association. Béton Provincial, led by André Bélanger, acquired the Joliette cement plant and operates it under the Ciment Saint-Laurent banner. I am delighted by their decision to join the CAC. Béton Provincial’s impressive success in the concrete world is poised to translate into cement production, undoubtedly benefiting our collective undertakings.

Every team member has contributed to our successes in 2024, and while I could highlight the achievements of each of them, I want to take this opportunity to recognize the exceptional work of Sarah Petrevan. In 2024, she was honored with the Carbon Capture Canada’s Emerging Leader in CCUS Award. In recognition of her contribution to developing low-carbon procurement policies, she also received the Canada Green Building Council’s Green Building Champion Award. Sarah holds the distinction of being the first non-building sector professional (engineer, architect, etc.) to win this award, and the first from any industry association.

I also want to recognize the fabulous work of our communications team comprised of Dan Valin and Derrick Simpson. We are breaking new ground with our wildly successful podcast, “Speaking Concretely,” which I am honoured to host. It has garnered over 100,000 unique listens! Our social media presence also grew and evolved substantially in 2024, with more engaging and diverse content as well as a fresh tone. We don’t just aspire to be leaders; we aim to define what leadership means. And we are finding our voice!

Through 2023, we proudly led with a strong focus on our net-zero messaging and Action Plan, setting the standard for industrial decarbonization leadership. However, true leadership is dynamic and adaptable, learning and evolving as it strives to shape the world. In 2024, our leadership began a transformative change. Without diminishing our sustainability messaging, we began to re-imagine traditional narratives about the value of our sector to society with renewed confidence and more effective use of digital tools.

This shift in tone and content is timely and forward-thinking, aligning with a public increasingly preoccupied with pressing issues like the cost of living, housing affordability, and employment stability. As fatigue with conventional climate messaging sets in, this evolution presents a unique opportunity for our sector to remain at the forefront of leadership by integrating climate and sustainability with the broader social and economic headwinds facing Canada and the world.

We can now clearly articulate how the path to decarbonization is also a blueprint for innovation and productivity. With the right conditions, decarbonization can attract significant investment, generate quality jobs, and expand export markets—all while delivering critical solutions for sustainable, affordable and resilient housing and infrastructure. This approach allows us to demonstrate that climate action is not a standalone agenda but a dynamic driver of economic and social progress. By connecting sustainability with the pressing needs of everyday life, we position ourselves not just as leaders in climate action, but as partners in creating a resilient, prosperous, and inclusive future.

Looking at the year ahead, it can certainly be said that we are living in interesting times, a phrase that captures both the opportunities and the trials of an era defined by upheaval and uncertainty. At the forefront of these challenges is the unpredictable impact of Donald Trump’s presidency, particularly his threats of tariffs on Canadian goods. For a trade-reliant nation like Canada, these potential tariffs could destabilize key sectors, straining industries that depend on open and predictable access to U.S. markets. Trump’s rhetoric and policies inject uncertainty into long-established trade relationships, forcing businesses and policymakers to prepare for disruption.

Closer to home, Canada itself faces political uncertainty. With the resignation of Prime Minister Justin Trudeau and the anticipated election of a new Conservative government in the coming months, the country’s policy direction is poised for a shift. This transition inherently brings instability, as businesses and investors speculate about potential changes to taxation, trade, and environmental policy, as well as public spending. This uncertainty compounds the already fragile economic environment, where housing and infrastructure investment struggles to recover from the burden of inflation and high interest rates. If tariffs materialize and political uncertainty persists, it could exacerbate these market challenges, delaying critical investment and further straining an economy trying to restructure. In this trifecta of challenges, the need for adaptability and resilience has never been more vital. Certainly, the CAC will be navigating a landscape that will test our ability to respond effectively to change.

Surrounded by a highly competent and committed team, a strong and aligned Board of Directors, as well as supportive Allies, I welcome 2025 and am fully confident that we will continue to navigate challenges, seize opportunities, and achieve meaningful progress toward our shared goals, driving impact and innovation in everything we do.

Thank you for your unwavering support, collaboration, and best wishes for a Happy, Healthy, and Prosperous 2025.

Adam Auer

President and CEO

Cement Association of Canada

Industrial Decarbonization and Sustainability

Guided by our industry leading Concrete Zero: Canada’s cement and concrete industry action plan to net-zero, CAC’s focus in 2024 was to drive the changes needed to support our goals of reducing emissions while maximizing competitiveness. Our Industrial Decarbonization team focused on vital topics such as carbon accounting, procurement and public investment, proving ourselves once again as a leading and influential voice. In 2024, we also worked on updating the data required for our industry action plan, and we are working to release an update in 2025.

Policy Agenda: Supporting Competitiveness, Driving Decarbonization

A significant focus for the CAC over the past year has been to support our members in accessing public investment in decarbonization focused capital projects. We played a crucial role in helping members and allies attract funding for well over $2 Billion in decarbonization projects across a spectrum of technology strategies, including carbon capture to low-carbon fuels and blended cements. We also continued to engage on the design and progress of important investment tools such as the Canada Growth Fund, Federal Investment Tax Credits, Strategic Innovation Fund, provincial economic development programs, and more.

Enabling decarbonization policies were also a major focus in 2024, as we actively represented our industry in numerous government consultations, including legislation to enable CCUS in Ontario, Ontario’s renewed hydrogen strategy, federal government investment tax credits, and comments on the powers awarded to the Competition Bureau of Canada to investigate and act against greenwashing.

This year, Ontario made notable progress advancing CCUS projects in the province. Through effective advocacy, we were able ensure that federal investment dollars on offer to support CCUS will be applicable to Ontario projects and that viable carbon storage can soon be accessed. CCUS projects are complex from both a technical and a financial perspective, and the CAC will continue to lobby the province to ensure that policy design meets the needs of the cement industry.

2024 also saw continued attention to carbon pricing and related policies. Increasingly, the CAC is seen as the pragmatic industrial leader in this conversation – providing commentary to media and numerous presentations at conferences and panels on the value of pricing systems and their impact on investment and competitiveness, opportunities to improve carbon pricing in Canada, and the role of border adjustment mechanisms. We were also asked to engage with the Commission on Carbon Competitiveness to give them a better understanding of the competitiveness issues faced by the cement industry.

Promoting the Adoption of Recycled Aggregates in Ontario

In Ontario, less than 10% of used aggregate is recycled, with the rest ending up in landfills. Utilizing locally recycled aggregate helps reduce costs by sourcing materials closer to market, while also extending the life of existing pits and quarries. Increasing the use of recycled aggregates not only supports job creation but also contributes to affordability, aiding in the province’s housing and infrastructure development.

Looking ahead to 2025, the CAC will collaborate with members and partners to develop a Quality Assurance/Quality Control (QA/QC) protocol for recycled aggregates. A robust voluntary industry protocol ensures consistency, reliability and compliance of recycled aggregates with industry standards (OPSS.MUNI 1010) and boosts confidence in the quality of recycled aggregate in their use for specific applications.

The QA/QC protocol would supplement ongoing industry advocacy by the Toronto and Area Road Builders Association (TARBA) and other building and construction partners that includes:

- Harmonizing and standardizing municipal specifications through the OPSS.MUNI 1010; and

- Mandating a minimum 25% recycled materials, when available, on all linear public infrastructure projects at the municipal, regional, and provincial levels.

Charting a New Course: Implementing our Carbon Accounting Taxonomy

The CAC developed a carbon accounting taxonomy with the advice and support of the Board of Directors. The goal of the taxonomy is to lead the development of a transparent, robust, and stringent framework for carbon accounting that enables the cement and concrete industry to meet the ambitious goals set out in our Concrete Zero Action Plan. Our needs are identified in four distinct, yet interdependent pillars:

- measuring our progress and improving data collection and measurement to support the action plan;

- informing public policy by defining low carbon cement and improving the comparability of Environmental Product Declarations (EPDs) ;

- supporting innovative technologies; and

- monetizing carbon reductions outside the regulated market (e.g., CCUS).

In 2024, key progress was made in advancing the taxonomy’s objectives:

Cement Product Category Rule: The CAC worked with members to push for tighter rules around allowable data, the inclusion of carbon capture, utilization and storage within the system boundary, and mechanisms that would trigger a PCR update/review sooner than the traditional 5-year period. These changes are a key step forward toward supporting the development and creation of truly comparable “commercial-ready” EPDs. Because of CAC’s leadership at the Cement PCR table, staff have also been sought after to support future concrete PCRs, including the Concrete Masonry and Segmental Concrete Paving Products PCR.

In parallel, the CAC secured up to $360,000 in funding from the National Research Council to continue to support the development of commercial-ready EPDs through better data protocols. Phase one of this project included a baseline assessment of all members cement facility-specifics EPDs. It showed that there are often significant differences in how EPDs are approached by members and the broader industry, resulting in wide variations in reported Global Warming Potential (GWP) values. Phase two will begin in 2025 following the release of the draft Product Category Rules (PCR) for cement and will focus on aligning on a set of assumptions, interpreting the PCR across the CAC membership and piloting it across EPDs.

Market Development Tools: In 2024, we advanced industry principles to help guide members and the market as they seek to build the business case for decarbonization projects, and lower carbon cement and concrete products. Against a rapidly evolving political environment, such as carbon pricing and climate funding instability, changes to the Competition Act, etc. we commissioned research from Lisa DeMarco, a globally-leading lawyer in sustainability and climate issues, to guide our future work on market development, in alignment with current and emerging laws, standards and best practices.

Adam Auer speaking at the Canadian Climate Institute’s Net-Zero Edge Conference in Ottawa.

Collaboration: Achieving the ISED/CAC Roadmap to Net-Zero Concrete and Preparing for Updates to Concrete Zero

In 2022, we released the joint Innovation, Science, and Economic Development Canada/CAC Roadmap to Net-Zero Carbon Concrete and followed it up in 2023 with the release of our industry action plan Concrete Zero.

We have made substantial progress implementing the Roadmap with ISED, securing close to $600,000 to support the implementation of our carbon accounting taxonomy and our education and engagement work. We are also well positioned through the National Research Council (NRC) to develop an industry-focused research program. This program will support the objectives and milestones identified in the CAC/ISED Roadmap and will drive Canada to organize research activities whose outputs support the international Cement and Concrete Breakthrough Agenda launched at COP28. This research program could lead to a further $2 million in support for industry supported initiatives. The cement and concrete industry and the CAC are a trusted and collaborative partner of ISED and the NRC – and this is now starting to be directly reflected in secured funds to support our agenda.

Increasingly, ISED looks to the CAC to support the implementation of the International Cement and Concrete Breakthrough Agenda. In addition to presenting at numerous international meetings on topics such as carbon pricing and CCUS advancement, increasingly ISED looks to the CAC for support in managing strategic relationships with international entities such as the GCCA, the Industrial Deep Decarbonization Initiative (IDDI), the Climate Club, and others. We expect that an update to the ISED/CAC Roadmap will be announced in 2025 when funding is secured for several priorities identified in the Roadmap, including decarbonization projects.

Research Agenda: Supporting Competitiveness, Driving Decarbonization

We continue to align our research agenda towards supporting the future competitiveness of the cement industry in a decarbonized economy.

Market development: We commissioned a legal brief on how to market and monetize increasingly lower carbon to net-zero cements within the regulated carbon pricing systems, the voluntary carbon market, and via other mechanism such as book and claim. This was also done to better understand and assess the industry’s risk profile in marketing lower carbon to net-zero cements with stronger laws in Canada coming into force around greenwashing.

Definition of Cement: Related to carbon markets, we initiated research to better understand the role of supplementary cementitious materials (SCMs) and their impact within regulated carbon pricing systems via the definition of cement. This work will be crucial as we engage with the federal government leading up to the review of the federal output-based pricing system in 2026 (work will begin in 2025). We will likely see a new government in Ottawa with a different approach to climate policies, and we seek alignment across provincial pricing systems.

Economic Equilibrium Sturdy: In support of the ongoing development of our Action Plan, we commissioned an economic study to forecast the commercial availability and economic viability of decarbonization technologies across Canada, based on the modeling and assumptions that comprise our Concrete Zero Action Plan.

Zero-Emissions HDVs: We also commissioned a study on the future trajectory of zero-emission heavy duty vehicles (with a focus on ready-mix and cement trucks,)The study on net-zero vehicles was funded in significant part by government, who contributed approximately $75,000 to the project, and the release of the report is expected in 2025.

Construction

Innovation

Concrete Zero – Education

In May of this year, the CAC was pleased to welcome Rob Cooney as our new Vice President of Construction Innovation. Among Rob’s primary responsibilities is developing from the ground up, a robust Education and Engagement platform, designed to both secure deep alignment among members and allies as well as with procurement, architectural, construction and engineering community on achieving our Concrete Zero Action Plan objectives.

In 2024, Rob successfully negotiated a collaborative proposal with the NRC to create a Concrete Zero training curriculum. The NRC has accepted and approved the proposal internally to fund the project with $250,000. This initiative will develop and disseminate a robust education and engagement strategy to support the development and growth of the market for lower-carbon cement and concrete. This platform will target specific and vital audiences in the construction decision-making value chain, including cement and concrete industry professionals, specifiers and engineers, procurement officers, architects, green building professionals, and policymakers. In preparation for launching this initiative, the CAC has worked with the CCC to draft an outline for critical topics and modules for development and has assembled an advisory panel to review and prioritize the topics and content. The advisory panel will comprise representatives from architects, engineers, cement and concrete industry professionals, and builders.

As we work to development this new platform, the CAC continues to engage, educate, and support members and allies in understanding and advancing the broader strategic priority of net-zero and how it impacts business development and competitiveness. For example:

- The CAC worked with Concrete Ontario to develop an “on-demand” one-hour webinar and in-person presentation deck to showcase the content of the Concrete Carbon guide, co-developed by CRMCA and CAC. The webinar provides guidance on specifying low-carbon concrete for various concrete project types and achieving low-carbon concrete goals. This resource focuses on the growing importance of embodied carbon, understanding concrete and carbon, the importance of using performance-based concrete construction specifications, and the best practices for procuring and designing projects to have low embodied carbon concrete outcomes. The Concrete Carbon webinar incorporates the information from Strategies for Low Carbon Concreteand provides practical strategies for designers and specifiers to put carbon reductions into action in their Canadian projects. CRMCA and CAC will co-launch the one-hour webinar in 2025, and it will be available to all members of the CAC and the CRMCA.

- We worked with allied associations such as the Canadian Concrete Masonry Producers Association (CCMPA), Concrete Ontario, and the Canadian Ready-mix Concrete Association (CRMCA) through the Concrete Council of Canada (CCC) to support the development of low-carbon cement and concrete products education.

- The CAC worked with the CCMPA to develop and deliver half and full-day in-person carbon education sessions to more than 300 participants across four events hosted in Ontario and the Atlantic. In particular, the CAC developed an hour-long session that provides the context and details of the Concrete Zero Action Plan.

- The CAC also participated in numerous external engagements with construction professionals and organizations, including the Canada Green Building Council (CAGBC), the Royal Architectural Institute of Canada (RAIC), the Centre for a Sustainable Built Environment (CSBE), the Federation of Canadian Municipalities (FCM) (among many others) on strategies, policies and practices to realise our Action Plan goals and to align collective efforts toward decarbonization of the built environment.

The CAC has actively collaborated with key influencers and decision-makers in the Procurement, Architect, Consulting, and Engineering (PACE) community. Our actions include our gold-level sponsorship of the CLF Toronto 2024 Awards in November. CAC team members have also been providing presentations on Concrete Zero Action Plan to leading builders, developers, engineers, and architects.

Buy Clean

The CAC has actively promoted the adoption of procurement policy requirements by all levels of government to reduce the embodied carbon associated with construction and increase the acceptance and uptake of lower-carbon cement and concrete. The Government of Canada has not developed an official Buy Clean strategy that is consistently applied across its operations and funding streams. Despite the lack of a national strategy, the CAC has been successful in advocating for the expansion of Buy Clean policies, such as the TBS Standard, to other areas within the federal government. This advocacy has taken many forms: letters of support, direct meetings with key officials, and advocacy through indirect channels. In June, the Centre for Greening Government announced that it is broadening the application of Greening of Government Strategy from federal departments to include Crown corporations. This represents a $18.8 billion yearly increase in the amount of funding that Buy Clean policies, including the TBS Standard, will now apply to, as highlighted in the CEC report, Money Talks, figure below.

Additionally, CAC is collaborating with Housing, Infrastructure and Communities Canada (HICC, formerly Infrastructure Canada) to encourage HICC to incorporate Buy Clean policies, such as the TBS Standard, into their grants and funding programs. This advocacy work has resulted in HICC announcing that they will take a phased approach to apply measures to disclose and reduce embodied carbon in future new programs as appropriate, focusing on major projects with the highest potential for emissions reductions, in Natural Resources Canada’s latest report, The Canada Green Buildings Strategy: Transforming Canada’s buildings sector for a net-zero and resilient future.

In support of our procurement agenda, the CAC has also worked closely with Clean Energy Canada (CEC) and the Pembina Institute, resulting in research and advocacy that underscores the importance of progressive policies to support the uptake of lower carbon building materials – also known as Buy Clean. The focus of this collaboration has been on addressing persistent knowledge gaps on the cost and availability of lower-carbon materials.

The Pembina Institute has hired a resource who is fully dedicated to research and advocacy around the industrial decarbonization of the cement industry. This year, in close collaboration with the CAC, Pembina developed several research materials on the importance of low-carbon cement, including their report, “The Opportunity to Lead on Clean Concrete Procurement and Performance-Based Specifications to Support the Clean Cement and Concrete Industry in British Columbia,” which was released in December. The report provides an accurate review of lower-carbon concretes available in BC, how existing CSA standards support them, and the benefits of performance-based specifications. It also recommends that the BC government implement a Buy Clean policy by adopting an approach like the Government of Canada’s Treasury Board Standard on Embodied Carbon in Construction (TBS Standard).

We also continued our partnership with Clean Prosperity, supporting their research and advocacy on carbon pricing, and related investment tools including carbon contracts for difference. The CAC signed onto a letter with several other industry associations, encouraging the provinces to collaborate with the federal government to bring strength and durability to carbon pricing systems in a way that supports competitiveness. In this letter we signalled our desire for fungibility between pricing systems – that is the ability to move compliance credits, and the importance of protective measures such as border carbon adjustments.

Provincial/Municipal Work

Metro Vancouver is developing a corporate low-carbon procurement policy to reduce the carbon footprint of concrete procured by Metro Vancouver for its infrastructure projects. The new policy will support Metro Vancouver procurement decisions involving concrete and concrete products. CAC has actively participated in the industry panels, encouraging them to adopt Buy Clean policy approaches like the TBS Standard.

Similar efforts are underway in other provinces and municipalities. Part of the funding received from NRC for our Education and Engagement will be directed towards developing low-carbon concrete procurement toolkits to facilitate and standardize the adoption of low-carbon concrete procurement policies aligned with the TBS standard.

Research & Development

The CAC has been working with the NRC to develop a collaborative industry-focused research program. The NRC has verbally committed to providing $2 million to this research program. The CAC and the NRC will chair the steering committee that oversees this research program. The steering committee and the research program will bring together members of the Canadian cement and concrete industries and researchers from NRC to:

- Support the NRC to formulate collaborative R&D research projects to address technology gaps and design projects to support market acceptance of technologies and processes that support decarbonization;

- Support the development and coordination of national-level projects that support the international Cement and Concrete Breakthrough initiative;

- Solicit members from the Canadian cement and concrete industries to provide advice on the needs and priorities of industry to decarbonize and identify the challenges for the implementation of technologies and processes that support decarbonization;

- Review the progress of projects that support decarbonization to offer suggestions to increase effectiveness, impact, and acceptance; and

Support the construction sector’s uptake of decarbonization technologies and processes.

Legislative and Regulatory Affairs

Governance

Significant changes to the Competition Act were made through Bill C-59 in June 2024. These amendments are meant to improve greenwashing regulations. In collaboration with McMillan LLP, the CAC provided two webinars in early September to provide members and allies with more information regarding the changes and how they can impact how we do business.

National Pollutant Release Inventory (NPRI)

Cement manufacturing facilities continue to report their releases to the environment through the NPRI administered by Environment and Climate Change Canada (ECCC). A CAC representative sits on the NPRI multi-stakeholder Work Group, which provides advice to the federal government on the implementation of the NPRI program. ECCC has proposed to add reporting requirements for 131 per- and polyfluoroalkyl substances (PFAS) to the NPRI starting with the 2025 reporting year. A PFAS will be required to be reported by any facility that manufactures, processes, or otherwise uses 1 kilogram or more of that PFAS at a concentration of 0.1% by weight or more. The government is currently reviewing comments received during the consultation period. The CAC will continue to monitor this initiative in 2025 as it may impact our members.

Other Issues

We continued in 2024 to monitor other national and international policy and regulatory initiatives that could have an impact on cement manufacturing activities. This included the risk assessment and risk management activities of the federal government for specific substances under the Chemicals Management Plan (CMP), as well as air quality policy development and implementation.

Political

Landscape

As the voice of the cement and concrete industry on Parliament Hill, the CAC follows the federal political trends and developments. In 2024, we witnessed the current Liberal government plummet in the polls, largely due to the unpopularity of Prime Minister Justin Trudeau. While the Supply and Confidence Agreement between the NDP and the Liberals has allowed the Liberal minority government to remain in power over the past several years without the threat of an election, a surprising development this fall saw the NDP withdraw from the agreement, leaving the governing Liberals in a more precarious position. The governing Liberals have also faced internal dissent, which ultimately led to the Prime Minister’s resignation.

The Conservative Party, led by Pierre Poilievre, and with a double-digit lead in the polls, is anxious to go to the polls in 2025. As time goes on it will be increasingly difficult for the NDP and the Bloc Quebecois to prop up the government. Despite this, it is still uncertain when a federal election will actually happen.

As such, the CAC has started to engage with the Conservatives, recognizing the high probability they will form the next government. The Conservatives pose an interesting challenge, campaigning hard on “axe the tax”, which is largely believed to be focused on the consumer carbon price, but so far silent on the industrial portion of the carbon price mechanism and on climate policy in general. We have engaged directly with Pierre Poilievre’s office and some of his policy advisors. We have also taken the chance to meet with MPs in the Conservative Party, to deliver our messages on competitiveness, jobs and the Canadian economy. We have focused our message on the conditions necessary for competitiveness, including a predictable fiscal and regulatory environment, resilient, affordable and sustainable supply chains such as access to reliable and affordable clean electricity, and the importance of market incentives and reduction of red-tape barriers.

We have also been approached by Poilievre’s office to visit our cement and concrete facilities. In May, he visited the Lafarge cement plant in Richmond, BC and more recently was at Yard at a Time concrete facility in Vancouver. We continue to work with his office on opportunities to showcase our facilities and educate him on the industry.

The first quarter of 2025 will be focused on working with the current government on key priority initiatives to ensure their completion prior to a federal election, and continued engagement with the Official Opposition to educate them on the industry and our key priorities.

With the Conservatives’ focus on workers, we will be working with our members to identify opportunities for the Conservative Leader and his MPs to meet and speak directly with workers at the plants and facilities.

This past year was also a busy year in provincial politics, with four elections, including three where the incumbent Premier was re-elected. David Eby pulled off a majority victory in British Columbia after a campaign where his NDP party and John Rustad’s Conservatives were almost tied in the polls throughout the campaign. In Saskatchewan, Premier Scott Moe won his fifth consecutive majority government, and in Nova Scotia, Conservative Premier Tim Houston called an early election and sailed to a convincing win. There was a change of Government in New Brunswick where Susan Holt’s Liberals defeated the governing Blaine Higgs’ Conservatives. Premiers in Alberta, Manitoba and Ontario continued to enjoy high popularity, while François Legault’s CAQ government in Quebec experienced another difficult year and stands far behind the Parti Québécois in the most recent polls. Looking ahead, we will see provincial elections in Newfoundland and Labrador in 2025. Both Ontario and Quebec have their next election scheduled for 2026. Ontario Premier Doug Ford has triggered an early election which is taking place on February 27th, 2025.

Western Region Highlights

Government Relations

British Columbia

Following a very tight election in October, Premier Eby emerged victorious in forming a majority government. The BC NDP secured 47 seats to the Conservative Party’s 44. The BC Green Party won 2 seats and will continue to wield significant power on key votes that could trigger another election.

The new Cabinet brought several new Ministers to significant roles for the industry. This includes a new Minister for Energy and Climate Solutions that will be responsible for the Climate Action Secretariat. The cement riding in Richmond-Queensborough was won by newcomer Steve Kooner (Conservative) and Delta South was won by incumbent Ian Paton (Conservative). Local government relationships will now fall to the Intergovernmental Relations Secretariat in the Office of the Premier and capital planning and procurement will be collapsed into one single Ministry of Infrastructure. With new Ministers of Environment, Transportation, Infrastructure and Labour it will be critical to get in front of the new Ministers to educate them on our key files in early 2025.

Spring 2025 will present an opportunity to participate in a lobby day event in collaboration with our colleagues from Concrete BC. There are plenty of new faces in the BC legislature as a record 56 rookie MLA’s were elected that will need to get up to speed on the workings of government and also on the great work done by CAC members and our allies across the province in promoting the cement and concrete industry.

In September, we once again joined our Concrete BC partner at the Union of BC Municipalities conference. By hosting a booth at this annual event, we had the valuable opportunity to connect with municipal politicians from across the province, sharing insights about Concrete Zero and exploring strategies to reduce GHG emissions in their communities.

Alberta

2024 proved to be a solid year for Premier Danielle Smith and her majority UCP government. The year began with Budget 2024 where a modest $300 million surplus was projected. Maintaining the government’s commitment to fiscal responsibility and efficiency in delivering public services, the government is now forecasting a surplus of $2.9 billion ($2.6 billion more than anticipated). The government has responded to the needs of the rapidly growing population in urban areas by introducing grant programs to finance infrastructure needs.

Forecast at $8.5 billion, the 2024-2025 Capital Plan continue to focus on key investments that are good for our industry including municipal infrastructure projects, major roadway corridors, as well as housing, education, and healthcare facilities.

Danielle Smith’s popularity within the UCP party is at a record high with confidence results of 91.5% as the last annual meeting held in Red Deer in November. With over 6,000 delegates in attendance, this event set the attendance record for the largest party convention for any party within Canada, both federally and provincially.

Plans to host a lobby day with the UCP government in Spring of 2024 did not materialize as our members were already actively engaged with Ministers on a number of important files. However, we did have a large presence at the Calgary Stampede, once again sponsoring the kick-off reception held by New West Public Affairs and attended by Cabinet Ministers and MLAs. The reception offered the opportunity to get face time with many of the key Ministers and Premier Smith. Several CAC members participated in various Stampede activities, engaging with politicians throughout several days.

We will continue to look for opportunities to maintain our strong relationships with the government throughout 2025.

Saskatchewan

Scott Moe’s Saskatchewan Party won its fifth consecutive majority government in October. Despite another solid majority, Premier Moe faced a surge in NDP support losing seats in over 2 dozen ridings including key urban areas in Saskatoon and Regina.

The 2024-2025 Budget delivered the largest total capital budget in the history of the province at $4.4 billion. Infrastructure, Healthcare as well as anticipated capital spends from crown corporations including SaskPower, SaskEnergy, and SaskTel received the largest allocation of funding to replace aging infrastructure.

The CAC will be working closely with our Concrete Sask allies to participate in a Lobby Day event in Saskatchewan in the first half of 2025.

Manitoba

Manitoba remains a stable political environment under the leadership of Premier Wab Kinew. Planned infrastructure investments in 2024-2025 total $2.8 billion including an estimated spend of $800 million for crown corporations including Manitoba Hydro.

Challenges and opportunities for our industry both occurred in 2024 with the City of Winnipeg instituting a temporary increase to cement content in concrete as a result of performance challenges stemming from the 2023 construction season. Led by Ahmed Soliman, Executive Director of Concrete Manitoba, a number of learning opportunities unfolded, including an increased awareness of field-testing procedures and other best practices. We look forward to the City of Winnipeg reverting back to their lower cement content specifications as construction results in 2024 appear to have been favourable.

Market and Technical Affairs

The CAC remained active and committed to our allies across the region working collaboratively to share information with municipal and provincial agencies and other stakeholders with the goal of expanding Concrete Zero awareness. We started out of the gates early and prepared and delivered a webinar as part of the Transportation Association of Canada’s (TAC)’s corporate demo webinar series.

Spring remained very busy with a number of excellent events including the Canadian Concrete Pipe & Precast Association’s AGM, Concrete Manitoba’s AGM and inaugural Battle of Prairies Charity Hockey game, and Concrete Alberta’s AGM and convention. A shout out to Jude Tremblay (CCPPA), Ashley Campbell (Concrete Sask), Ahmed Soliman (Concrete Manitoba), and Dan Hanson (Concrete Alberta) as well as their amazing team and organization volunteers who made space to keep the lower carbon conversation going.

The fevered pace continued into the summer of 2024 with many events where CAC was able to engage with other industries and stakeholders also on the decarbonization journey. These included delegates at the Building Lasting Change and the Federation of Canadian Municipalities conferences, industry professionals at allies’ golf tournaments, and another excellent networking event at the Calgary Stampede.

The Battle of the Prairies Charity Hockey Game between Concrete Sask and Concrete Manitoba featured a Concrete Trophy presented to the winner.

Fall of 2024 did not provide much of an opportunity to catch our breath. Metro Vancouver advanced the work of its’ waste and recycling advisory committee and the City of Richmond continued to advance the foundation for their embodied carbon reduction strategies, examples of two initiatives we have actively been involved with throughout the year. The Union of BC Municipalities (UBCM) had its annual conference in Vancouver that ran directly into TAC’s Annual Conference. We were pleased to have collaborated with Concrete BC’s Jason Saunderson on both these well attended events.

As we pushed towards the end of 2024, the CAC had the opportunity to attend Concrete BC’s AGM and Convention, the Alberta Municipalities Convention and Trade Show, AMO, and the CCPPA’s Fall Meeting. We participated in a panel discussion at BuildEx Calgary with our colleagues from Alberta Masonry Council (Mark Hagel) and Concrete Alberta (Dan Hanson). Finally, we had the opportunity to share information with Concrete Sask membership at their AGM in Saskatoon. Thanks to Concrete Sask’s Ashley Campbell for hosting another excellent event.

Ontario Region Highlights

After a tumultuous 2023, the Ford Conservative government was relatively stable in 2024, holding a significant lead in the polls over the Opposition NDP and the Liberals. While the next provincial election was not scheduled until Summer 2026, the Premier decided to call a snap election taking place February 27th, 2025 if the polls continue to hold, we can expect another Conservative majority government.

The current government continues to recognize the importance of competitiveness for the industry and show support for many of our key priorities including: infrastructure investment, protection of employment lands, recycled aggregates, and carbon capture, utilization and storage (CCUS).

Government Relations

Over the past year we have engaged in several in-person events to advance key initiatives of our member companies and the CAC. We continue to look for partnership opportunities with our allies and other industries to advance priorities.

Pre-Budget Submission

Our pre-budget submission this year focused on the following themes:

- Continued investment in infrastructure, while at the same time addressing land compatibility issues and protecting employment land.

- Delivering a comprehensive roadmap for CCUS in Ontario to enable a predictable investment environment for CCUS projects.

- Developing a protocol to increase the use of recycled aggregates in the province.

- Establishing a demand for low-carbon materials through the strategic use of procurement.

- Leveraging the Emissions Performance System to protect competitiveness and attract low carbon investment.

Over the past year, the CAC focused on advancing these key initiatives. Through meetings, submissions, and advocacy efforts, we worked to advance these priorities while also showcasing our Concrete Zero Action Plan.

We were encouraged to see progress on several fronts, with the province taking steps to protect employment lands and ensure the issue remains top of mind and introducing enabling legislation for CCUS. These are critical actions that align with our objectives. Looking ahead to the first quarter of 2025, our efforts will center on promoting the increased use of recycled aggregate. This includes collaborating with industry partners such as Ontario Stone, Sand & Gravel Association (OSSGA), Ontario Road Builders Association (ORBA), Toronto and Area Road Builders Association (TARBA), and others to emphasize the substantial benefits recycled aggregate offers for essential infrastructure projects.

On an ongoing basis we engage with members to advocate on site specific issues, including opportunities for funding from the Ontario government for local investments. We encourage all members to reach out when they are looking for assistance from the government, whether it is regulatory, legislative, or funding related.

Ontario Lobby Day

The annual lobby day, in partnership with Concrete Ontario, was held on November 18th. It was a productive day filled with back-to-back meetings with Ministers, ministerial staff, MPPs, the Premier, and representatives from the Premier’s Office. Our well-attended evening reception in the Ontario Legislative Dining Room brought together MPPs from all parties, Ministers, staff, and our valued industry partners.

This year we took a very targeted approach with three specific and no-cost requests:

- Establishing a Research & Development hub for carbon utilization to capitalize on this global market opportunity;

- Approving and promoting a voluntary industry protocol to support the use of recycled aggregate; and

- Adopting the Treasury Board Standard on Embodied Carbon in Construction to boost demand and market for lower-carbon materials.

Association of Municipalities of Ontario (AMO)

Together with the Masonry Council of Ontario we held a reception at the AMO Conference in Ottawa. We had the opportunity to host numerous municipal and provincial politicians from across the province at the reception and engaged with them extensively throughout the three-day conference.

Executive Director of the Masonry Council of Ontario Andrew Payne and Vice President of Public Affairs and Advocacy Martha Murray with Ontario Minister of Labour, Immigration, Training and Skills Development David Piccini.

Concrete Ontario Advocacy

In addition to the advocacy work done for the CAC, we also worked to advance specific issues for Concrete Ontario with the provincial government. This included Ministry specific meetings, budget and Environmental Registry submissions, and joint letters to the provincial government. We once again put in another application to the Skills Development Fund to enhance the recruitment and retention of drivers for the industry. We continue to look for opportunities to leverage the collective strength of our two organizations.

Quebec Region Highlights

The Coalition Avenir Québec (CAQ) Government, led by Premier François Legault, continues to show signs of fatigue after six years in power. The CAQ lost three MNAs this year, including the party whip Éric Lefebvre, who announced he will run for the Conservatives in the next federal election, and its star Minister Pierre Fitzgibbon who was handling the large portfolio of Economy, Innovation and Energy. In addition, the Minister of Health Christian Dubé indicated he will not run in the next general election.

Following a dramatic drop in popularity in 2023, the Government did better in 2024 but it is still trailing behind the Parti Québécois (PQ) in the most recent polls. If a general election had been held in mid-November, 35% of the population would have voted for the PQ compared to 24% for the CAQ, 17% for the Liberals, 13% for Québec Solidaire (QS) and 11% for the Quebec Conservative Party. According to the same poll, the level of satisfaction towards the Legault government is only 32%.

The Liberal Party has been without a leader for more than a year and will appoint a new leader in June 2025. The popularity of the party seems to have raised since former federal Liberal Minister Pablo Rodriguez announced his intention to enter the Quebec Liberal Party leadership race, where he is widely seen as the likely winner.

The CAQ, who had inherited a budget with surplus when it took power in 2018, is now facing criticisms for Quebec’s difficult economic situation. In March, Finance Minister Eric Girard presented his 2024-2025 budget carrying a $11-billion deficit. The Fall economic update showed a slightly more positive picture but the Government has imposed a hiring freeze on new public service employees as well as restrictions on overtime and travel expenses to limit spending. All departments and agencies have been instructed not to exceed their allocated budgets.

Votes intentions 2024 - If election had been held in mid-November

Government Relations

In the last few days of 2023, the Minister of Environment, Climate Change, Wildlife and Parks Benoit Charette sent a letter to all cement plants operating in Quebec requiring each of them to formally table by May 1st a detailed roadmap showing how they will reduce their GHG emissions over the coming years. The tone of the letter was somewhat threatening, which came as a surprise given the warm reception of our industry Concrete Zero Action Plan by the Minister a few months earlier.

The Government remains supportive of our action plan but is concerned about its implementation. Under pressure from the population on the climate file, the Legault government wants to see emission reductions in the short and longer term. To that end, CAC officials entered into ongoing and increasingly collaborative discussions with the Minister and his staff in the following months. We have helped CAC members understanding and accessing available funding programs and have also organized meetings between cement companies and senior bureaucrats as well as political staff. The CAC also initiated a discussion with senior bureaucrats regarding the streamlining of authorization processes for the use of low-carbon fuels in cement kilns.

In May, the CAC joined forces with four other associations (Tubécon, Association Béton Québec, Institut d’acier d’armature du Québec, and Association des entrepreneurs en coffrage structural du Québec) for two days of meetings with elected officials and senior government bureaucrats in Quebec City. The main objectives of the meetings were to raise awareness about the cement and concrete industry and its economic benefits for Quebec, and to educate government officials about the role of concrete as a sustainable and resilient construction material. A total of 34 participants from the industry contributed to the success of this initiative, and 23 meetings were held with government officials.

The CAC and allied organizations appeared at Quebec’s Parliamentary Commission on Public Finance on May 28, as part of the Commission’s hearings on Bill 62 (an Act to diversify the procurement strategies of public bodies and provide them with greater agility in carrying out their infrastructure projects). Our industry representatives emphasized the importance for the subcontractors to the general contractors (including the material suppliers) to be at the table when partnerships contract agreements are put in place. The video of the hearing can be seen here.

Industry Affairs

Working with partners remained a priority for the CAC in 2024. As a Board member of CPEQ (Quebec Environment Business Council), and a proactive player in CPEQ Committees, we took advantage of numerous meetings and opportunities throughout the year to discuss government programs and policies with other industry sectors, identify common concerns and develop joint strategies when appropriate.

CAC and member companies also continued in 2024 to participate in the Joint Committee with the Ministry of Environment, Climate Change, Wildlife and Parks. This formal committee provides a unique opportunity for cement sector representatives to get updates on all files from the Ministry that are relevant to our sector, to ask questions about these files and to express concerns as needed.

In addition to our work on the Concrete Zero Action Plan, the CAC and members have had interactions with government officials on many issues, including the cap-and-trade program and the proposed amendments to various regulations brought forward by the Government.

Cap-and-Trade program

In October, the Quebec government published a notice stating its intention to publish, in early 2025, a draft regulation to amend the Regulation respecting the cap-and-trade system for greenhouse gas emission allowances (RSPEDE). Among the elements likely to be included in the amendments are a gradual reduction in the limit on the use of offset credits by 2030, the transformation of the offset credit component into a reduction purchase mechanism as of 2031, and the upward adjustment of reserve prices, which acts as a price cap mechanism. As the implications for cement plants could be significant, CAC officials will analyze the draft regulations as soon as they are published, and work with members to advance and protect the interests of our industry.

Bill 81 – An Act to amend various provisions respecting the environment

On November 20, the Minister of the Environment, Climate Change, Wildlife and Parks (MELCCFP), presented Bill 81 to the Quebec National Assembly. The bill amends eight statutes under the Minister’s responsibility. The CAC is currently analyzing the proposed amendments and will work with members to determine potential implications for our industry. Our preliminary analysis indicates no significant impacts on cement plants. There is one proposed amendment to the Environmental Quality Act that may have a positive effect on GHG large emitters as it will allow emitting facilities to use their consigned funds towards CCUS projects (the current version of the Act does not allow CCUS projects to be eligible for funding from the consignment mechanism).

Access to Information

Following a recent court ruling, the Quebec Government has clarified its position regarding the processing of requests for access to information under section 118.4(4) of Quebec’s Environmental Quality Act. Any document or information covered by such request will be transmitted to those requesting it without notifying the owner of the information (since the documents covered by 118.4(4) are public in nature, according to the Court of Quebec ruling). The CAC, along with many other industry associations, has expressed concerns about this approach. Senior bureaucrats are currently assessing how the government can continue to offer the transparency required by citizens, while protecting the industrial and commercial secrets of companies. In the meantime, CAC members should be cautious when transmitting information to obtain or renew an authorization at an industrial establishment, since any person submitting a request for information will be able to obtain it without the company’s knowledge.

Market and Technical Affairs

An important part of our activities aims at promoting the sustainability and durability of concrete infrastructure. This is done through education on our industry action plan towards a net-zero concrete in 2050, as well as through communicating to government officials the importance of our sector to the economy and to the achievement of Quebec’s GHG reduction targets.

We sought to enhance our collaboration with our allies in 2024, making a deliberate effort to speak from a unified voice. We were pleased to be involved in many events throughout the year, including:

- Concrete Week. Association Béton Québec (ABQ), the Quebec concrete association, held its Concrete Week in St-Hyacinthe during the week of February 5-9. The event attracted over 270 participants, who had the opportunity to receive training sessions and attend conferences throughout the week. The CAC sponsored a cocktail event, where Adam Auer and René Drolet presented the industry’s action plan towards net-zero concrete.

- American Concrete Institute (ACI). We were proud to be a Gold sponsor of the ACI Quebec & Eastern Ontario Gala of Excellence in concrete design and infrastructure held in Laval in March. The event was attended by a broad range of actors in the construction sector.

- Grand Forum – Conseil des Infrastructures. In October, the Conseil des Infrastructures hosted its 14th edition of the Grand Forum, a large annual event attracting over 250 attendees from all sub-sectors of the infrastructure ecosystem. The CAC sponsored a luncheon at the event where René Drolet had the opportunity to present the key elements of Concrete Zero and introduced Quebec Minister for Infrastructure, Jonatan Julien.

- Association Béton Québec (ABQ) events. The CAC participated in ABQ’s annual general meeting (AGM) in April, as well as in the activities surrounding the ABQ annual cyclo-golf, where René Drolet delivered a joint presentation with ABQ’s Director General Luc Bédard on the roles of industry associations and what lobbying means in practice.

Atlantic Region Highlights

In Nova Scotia, Conservative Premier Tim Houston called an election nearly eight months early. His calculation paid off, with he and his party winning over two-thirds of the Legislature. This gives the Premier a very strong mandate to continue moving forward with his agenda. In New Brunswick, the Liberals defeated the governing Blaine Higgs and his Conservative party claiming 31 of the 49 seats available. New Liberal Premier Susan Holt ran on health care, housing and affordability but also announced that her mandate will ensure that all government buildings are net-zero and that the vehicle fleet, including school buses, is all electric by 2035.

In February 2024, the CAC was invited to present at the Atlantic Concrete AGM where we had the opportunity to meet with members and allies and present on Concrete Zero. At the same time we also met with the New Brunswick government to talk about the cement and concrete’s industry’s commitment to reaching net-zero by 2050. This past Fall we sponsored the Atlantic Masonry Institute’s Masonry Carbon 101 session at their 2024 AGM, featuring a presentation from CAC’s Rob Cooney.

The CAC continues to work with Atlantic Concrete and their members on what regional needs and messaging are required for governments, customers and stakeholders to advance the industry in the area.

Marketing and Communications

Podcast

CAC proudly launched a new podcast this year, called Speaking Concretely. The podcast has been a great communication tool for the association to educate our industry audience as well as the general public on the benefits of cement and concrete and the issues important to our industry. Since launching in June, the podcast has received over 100,000 listens. Topics have included sustainability, architecture, and innovation and technology. We are planning to launch the French version of the podcast in early 2025. While the podcast does get promoted to increase listenership, we are tremendously pleased to see how well it is being received.

Social Media

This year was a transformative year for us on social media, with CAC further refining our strategy to be more interesting and fun, while further showcasing the important work of our industry.

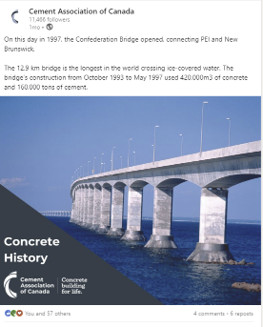

We saw great success in our “Concrete History” social media campaign, drawing attention to the essential role that cement and concrete plays in everyday life. To further cement the role of concrete in our everyday life, CAC also introduced a new series of short, animated videos as social media content. These new videos draw attention to the omnipresent nature of our industry while bringing special importance to the vital role the industry plays in the Canadian economy in every aspect of life. CAC also experimented with more funny and light-hearted content, with positive feedback.

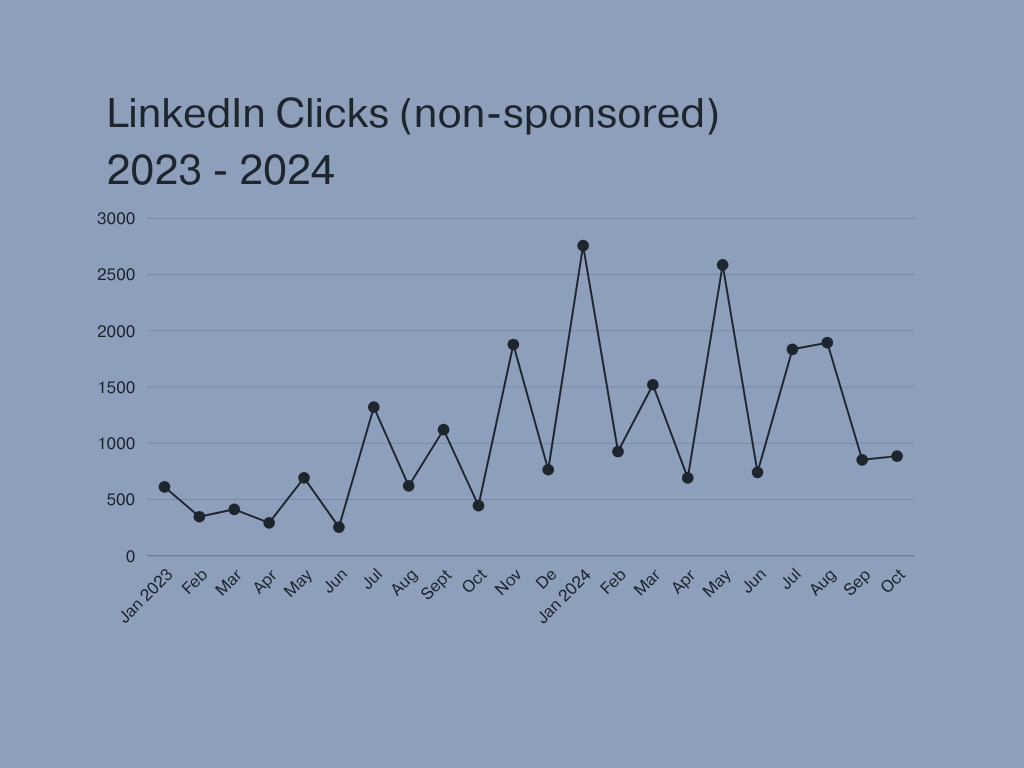

Our follower growth rate on LinkedIn has increased by 25%, climbing past the 10,000 followers mark this year and now reaching over 12,000 followers. We reached over 150,000 people on LinkedIn this year, a 50% increase over 2023. We also surpassed over 15,000 clicks this year, a 140% increase over last year.

We experience steady growth on Instagram and Facebook as well, with a 61% increase in engagement on Instagram and a 55% increase in engagement on Facebook.

Concrete Facts:

CAC Monthly

CAC continued to prioritize keeping our members up to date, updating the CAC monthly to include customizable categories for select partners and members. Topics included subjects like Climate change, politics, codes and standards, and specific regional updates. The CAC monthly had an email open rate of 45%, well above the manufacturing industry average of 32%.

Media Coverage

This year was an exciting time for our industry, with our industry focusing on innovation and reducing emissions. CAC received lots of positive media attention. CAC was featured in industry based publications including: On-Site Magazine, Cemnet, and World Cement. We were also covered in more environmentally focused publications like Corporate Knights, and Canada’s National Observer. In total, CAC was mentioned over 20 times in press releases and the mainstream media.

Market and Technical Affairs

Transportation and Public Works

Education and Training

Part of the CAC´s role is to help educate public / private owners, engineering / architect consultants, and contractors of the many benefits of cement and concrete products used in roadway applications and on the Concrete Zero Action Plan. To assist in this process, we updated our PLC technical summary document and organized / participated in several webinars and seminars. The following is a highlight of some of the education and training activities:

- University of Manitoba Presentation on Concrete Zero and Low Carbon Concrete. CAC staff gave a presentation at the University of Manitoba on the Concrete Zero Action Plan and low carbon concrete. The session was attended by 18 people including professors and graduate students.

- ACI Manitoba Presentation on Concrete Overlays. CAC staff gave a presentation on concrete overlays at the ACI Manitoba Chapter meeting. The presentation, which was attended by 45 people, covered why use concrete overlays, basics of concrete overlays, thickness design of overlays, Canadian based projects, US experience with overlays and sustainability of concrete pavements.

- Concrete Manitoba Pavement Workshop Presentation Using Performance Based Specifications to Produce Low Carbon Concrete. CAC Staff gave a presentation at the Concrete Manitoba Pavement Workshop on using performance-based specifications to produce low carbon concrete. The presentation, which was attended by 58 people, reviewed designer and owners’ role in reducing the carbon footprint of concrete, what is low carbon concrete and EPDs, and provided EPD calculations for concrete pavement.

- Meeting with WSP Staff on Concrete Sustainability. CAC staff had a virtual meeting with WSP staff to discuss our Concrete Zero Action Plan to net-zero, CAC’s PLC technical summary document, Concrete BC’s regional EPDs document, and Concrete Carbon – A Guide for Specifying Low Carbon Ready Mixed Concrete in Canada.

- Concrete Expo Presentation on Concrete Zero. CAC staff gave a presentation on our Concrete Zero Action Plan. The session was attended by 23 people with several requesting a copy of the presentation.

- CO / CAC Pavement Seminar. The one-day Pavement Seminar hosted by Concrete Ontario (CO) and the CAC was a great success with over 50 attendees including MTO employees, consultants and contractors. Great discussions occurred with many of the speakers, and we received very positive feedback on the seminar.

- Scott McKay Concrete Technology Course Presentations. CAC staff gave two presentations at the weeklong training session – one on Concrete Pavement 101 and the other on Concrete Innovations. The course was attended by 25 students and got a lot of discussions going on the various topics discussed including our industries’ Concrete Zero Action Plan.

- AMICO Lunch & Learn. CAC Staff gave a presentation on Concrete Zero and Low Carbon Concrete at the AMICO office in Mississauga. The presentation sparked several conversations on low carbon concrete.

- Public Services and Procurement Canada (PSPC) Virtual Meeting. CAC staff had a virtual conference call with several PSPC staff to discuss embodied carbon and implementation issues in remote areas. Staff gave a presentation on Concrete Zero and low carbon concrete so the PSPC staff could better understand what low carbon concrete was. Several documents on low carbon concrete and PLC were sent to the PSPC staff for their information and review.

- University of Waterloo Presentation on Concrete Zero and Low Carbon Concrete. CAC staff made a presentation on Concrete Zero and Low Carbon Concrete for the master’s and PhD engineering students and professors at the University of Waterloo. The presentation was well received with several questions asked.

- CAPTG / SWIFT Conference Presentations. CAC staff attended the CAPTG Workshop and SWIFT airport Conference held in Vancouver in September. Tim Smith gave a presentation at the CAPTG Workshop on Concrete Overlays and Gary Mitchell from ACPA gave two presentations one on Incorporating Sustainability and Resiliency into your Design and another on US Airport Concrete Pavement Technology Program Update. There were approximately 100 people in attendance at the presentations.

- TAC Fall Conference and Technical Committee Meetings. CAC staff attended the Fall TAC Committee meetings and Conference sessions networking with the many government agencies and consulting personnel present. Eight cement and concrete related presentations were given at the conference including presentations by CAC staff, member company personnel, Allied industry personnel, universities and consultants. CAC staff also took part on the panel discussion on Introduction to EPDs for Roadway Materials.

- NRC – Technical Committee for Infrastructure LCA Guidelines Roads, Bridges and Transit. CAC staff took part in this NRC initiative representing the Cement and Concrete Industry at the event and providing a presentation on Concrete Zero and Low Carbon Concrete.

- Good Roads Low Volume Roadways Workshop Presentation in Barrie. CAC staff presented at this workshop which was attended by 90 delegates and 46 people manning the booths. The Engineered Soils presentations was well received with several municipalities inquiring about the technology due to excess soils management requirements. Request were made for potential presentation at the individual municipalities.

- ACI Atlantic Workshop Presentation. CAC staff made a presentation on Concrete Zero and Low Carbon Concrete at the ACI Atlantic Fall Event which was attended by over 60 professionals from the cement and concrete industry. The presentation was well received with lots of questions from the attendees. The City of Moncton requested CAC staff to review their concrete related specifications to ensure lower carbon concrete is being considered.

- Highway 3 – Next Generation Concrete Pavement TAC Paper and Good Roads Quarterly Article. CAC Staff prepared a paper for the TAC Fall Conference on Highway 3 – Next Generation Concrete Pavement and a writeup on the project for inclusion in the Good Roads Quarterly Winter edition. The paper and article highlight the following information: roadway project details, excellent smoothness obtained during construction, decreased noise level due to utilizing longitudinal grooving, improved safety from the grooving texture and high-quality aggregates for longer lasting skid resistance, and reduced carbon footprint from using GUL cement and 25 % slag in the concrete mix design.

- Updated Concrete Pavements: Key Technical Resources Directory. CAC staff updated the old version of the document enhancing the sustainability section and adding links to new resources. The following is a link to the document posted on our CAC Expertise Centre – https://cement.ca/wp-content/uploads/2024/03/Concrete-Pavements-Key-Technical-Resources-Directory-2.0.pdf

- MIT SCHub Advisory Committee. Representing the Canadian Cement and Concrete Industry on the MIT SCHub Advisory committee to provide input on the MIT CSHub research work.

- Decarbonizing the Atlantic Concrete Association. Calls and e-mails with consultant working on the Scope of Work (SOW) document being created for a potential project on how to decarbonize the Atlantic Concrete Association members.

Technical Committee Involvement

- MTO OPSS Specification Reviews. CAC staff provided comments to MTO on the following OPSS.PROV specifications:

- PROV 1301 Materials Specification for Cementing Materials. MTO released a new version of the OPSS.PROV 1301 specification in November which includes the wording change requested by CAC to clause 1301.07.05 on testing. The CCRL test results are now accepted by MTO eliminating the need to hire independent consultants for verification of industry testing.

- OPSS.PROV 1350 Materials Specification for Concrete and OPSS.PROV 904 Construction Specifications for Concrete Structures – Materials and Production. Collaborated with Concrete Ontario to submit detailed comments on both documents and took part in the MTO stakeholder meetings to discuss industry comments. Some of the recommended changes were made to the specifications but MTO still doesn’t follow CSA classes of exposure and recommendations.

- MTO Stakeholders Meetings. CAC Staff took part in the MTO Stakeholders meetings to represent the Cement and Concrete industry. The five main topics discussed were – concrete curing temperature, cement replacement by SCMs, freezing and thawing resistance of concrete, MTO use of precast concrete and OPSS 904,1301 and 1350. CAC staff provided comments on each of the topics.

- Spalling of Concrete Barrier Walls. CAC staff took part in the discussions on the spalling of concrete barrier walls and noted the issue could be due to several things including the use of steel forms, improper curing or deicing chemical splashing on the barrier walls.

Acting as representative for the cement and concrete industry, CAC staff promote the many benefits of concrete pavements, cement-based roadway solutions and use of PLC to a number of organizations and technical committees including the Transportation Association of Canada (TAC) committees, Ontario Road Builders Association (ORBA) Structures Technical Committee, Concrete Ontario / MTO Liaison Committee, Good Roads Municipal Concrete Liaison Committee, Concrete Ontario Technical Committee, Concrete Ontario Sustainability Committee, Canadian Airfield Pavement Technical Group (CAPTG), PCA Voluntary Guidelines: Means and Methods Working Group, and the American Concrete Institute (ACI) committees.

Some of the key outcomes from our involvement with these committees are listed below:

- Manitoba Transportation and Infrastructure (MTI) Pavement Assessment & Design Manual (PADM) 2024. CAC staff reviewed and provided detailed comments on MTI’s draft PADM document with many of the recommended changes being adopted in the new document.

- CAPTG Planning Committee Meeting. The Canadian Airfield Pavement Technical Group (CAPTG) had a 2-day planning meeting to discuss the 2024 CAPTG Workshop and Technical Sessions at the 2024 SWIFT Conference. Based on the meeting there will be three concrete pavement related presentations: Why Incorporating Sustainability and Resiliency into your Design is the Right Decision, Concrete Overlays for Airfield Rehabilitations and Concrete Topic: Common Construction Problems and Mitigation Strategies.

- TAC Low Carbon LCA Working Group. CAC staff are a member of the TAC Low Carbon LCA Working Group which was created to investigate the carbon footprint of infrastructure related materials. CAC staff continue to be involved in the Subcommittee to ensure the cement and concrete industry’s interests are heard.

- TAC Materials Testing and Inputs for PavementME Design Working Group. CAC staff are a member of the TAC Materials Testing and Inputs for PavementME Design Working Group which was created to investigate the inputs to the PavementME software to improve the reliability of the pavement designs.

- MTO GreenPave Rating System Update. CAC staff provided detailed comments on the existing GreenPave rating system including comments on the use of EPDs, energy use of pavement types, noise level of longitudinally grooved concrete compared to old transverse tining, inclusion of GUL cement and the improved smoothness of next generation concrete pavement.

- ACI 327 Roller Compacted Concrete Pavements Guide. CAC staff reviewed and commented on the ACI TAC Review Group comments on the proposed update to ACI 327 Roller Compacted Concrete Pavement Guide.

Technical Assistance and Research

Another key role of the CAC technical staff is to respond to the numerous technical inquiries from government agencies, consultants and contractors on concrete pavement and cement-based roadway solutions. This includes providing current and relevant documentation on LCCA, LCA, PLC, low carbon concrete, concrete pavement repair and specification reviews. Design assistance for conventional concrete pavement and roller compacted concrete (RCC) design is also another important function of the technical staff, helping to ensure equivalent concrete and asphalt designs are being compared. A few key accomplishments in 2024 are described below:

- Department of National Defence (DND) Request for Information on Concrete Overlays. CAC staff had a virtual meeting with DND staff to discuss concrete overlays for potential use at their airport operations. Staff also provided detailed information on concrete overlays for the review of DND and gave a presentation on concrete overlays at the CAPTG Workshop in September.

- Englobe Request on GUL for Airport Pavements. CAC staff responded to Englobe’s questions on the use of GUL for concrete pavements giving examples where GUL based concrete pavement has been used in Ontario and Manitoba.

- Englobe Request on Tracked Vehicle Pavement Design. CAC staff provided technical assistance to Englobe for design of a concrete pad which will be utilized by tracked vehicles. Staff reviewed the tracked vehicle design procedure and forwarded documents to Englobe which would help in the design.